William (Bill) J. Arnone, NASI Board Chair

In a blog post on the National Academy of Social Insurance’s new public opinion study, the Committee for a Responsible Federal Budget (CFRB) asks, “Do Americans really favor a revenue-only approach to Social Security reform?”

The evidence indicates yes. Many surveys have found that Americans broadly agree on Social Security (in contrast to many polarizing issues) and do not want to reduce benefits. A recent survey from the non-partisan Pew Research Center, for example, finds: “Most Americans (67%) say that benefit cuts should not be an option when thinking about Social Security’s long-term future.”

Our study indicates that the American people understand that the purpose of Social Security is to help achieve basic economic security for workers and their families in retirement. Workers earn the right to benefits through their contributions. They are aware that benefits are modest, and clearly indicate a preference to maintain or increase benefits, not cut them.

The results of various parts of the study – focus groups, survey questions, and trade-off analysis – are consistent, and indicate that Americans across all ages, income levels and political affiliations prefer to balance Social Security’s finances by increasing revenues, without cutting benefits.

First, in focus groups, participants volunteered concerns about the low level of benefits, and many expressed surprise that a tax increase they considered manageable would address the program’s shortfall.

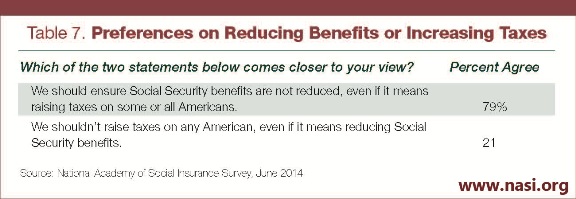

Second, the survey included direct questions that provide clear answers on Americans’ preferences. Given a direct choice between raising taxes or reducing benefits, 8 in 10 prefer to raise taxes, as shown below.

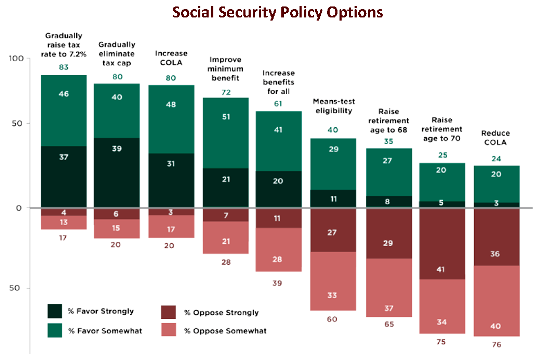

Third, the survey asked Americans their views on a balanced array of policy options, consisting of four benefit reductions, four benefit increases, and four revenue increases. Within those categories, the options were among those most widely discussed or frequently proposed. The benefit-reduction options were raising the retirement age to 68 or 70; reducing the COLA; and means-testing.

In short, respondents had many opportunities to choose benefit reductions, if they wanted – and most did not. The benefit cuts are the least popular options; none has majority support. In contrast, large majorities favor gradually raising the tax rate (83%) and gradually eliminating the cap on taxable earnings (80%), as shown below.

Finally, the trade-off exercise included the same balanced array of policy options, and found that large majorities of Americans prefer packages of changes that raise revenues and do not reduce benefits.

CRFB criticizes the study for not including large enough benefit reduction options, especially changing the basic benefit formula, to allow respondents to close the financing gap solely with benefit reductions. Given the consistency of the study’s results, it seems odd to suggest that more Americans might have found benefit cuts appealing if the cuts had just been deeper. This study, along with many other studies over the years, finds a clear indication that Americans prefer to balance Social Security’s finances with revenue increases and not with benefit cuts.

Brief responses to several of CRFB’s specific comments follow:

- With regard to reducing benefits for higher earners, there are two common approaches: changing the basic benefit formula (which looks at prior lifetime earnings) and means-testing (which looks at current income when the person receives benefits). Both options have been proposed by various groups. The means-testing option in this study was proposed by the Heritage Foundation, as noted in Appendix E of the study’s report; it is not a “straw man policy that no one supports,” as alleged by CRFB.

- With regard to changing Social Security’s cost-of-living adjustment (COLA), CRFB criticizes the study for not noting that many economists consider the chained CPI a more accurate measure of inflation. This was not an omission. While the chained CPI may (or may not) more accurately measure inflation for the general population, there is no evidence that it more accurately measures inflation experienced by Social Security beneficiaries.

- With regard to a Social Security tax increase phased in over 20 years, the study described the increase as workers would experience it – in deductions from weekly earnings. Benefit cuts were appropriately described in percentages because dollar amounts would vary considerably, given the range of benefit amounts.

In short, the study included a balanced array of options accompanied by accurate descriptions, including cost estimates from the Social Security Administration. As with all Academy products, the report was reviewed by Academy member experts to ensure that it meets the organization’s criteria for clarity, completeness, accuracy, and objectivity.

We appreciate feedback about this important survey, which did indeed find, as other studies have, that Americans across political, generational, and income lines value Social Security and would rather address its long-term financing gap by increasing revenues than by cutting benefits.

The National Academy of

The National Academy of Social Insurance has done a real service by conducting “trade-off analyses” to better understand how Americans would fix a Social Security program quickly headed toward insolvency. By forcing Americans to fully understand and weigh various options, rather than just asking about them in isolation, a trade-off analysis has the power to better simulate the tough choices that lawmakers will face in adjusting the program.

As we wrote in our blog (http://crfb.org/blogs/do-americans-really-favor-revenue-only-approach-social-security-reform), however, NASI’s trade-off analysis falls short in some areas that cause us to question the results. As we explained, the survey omits the single largest and most prominent set of benefit options – gradual adjustments to the initial benefit – which have been in nearly all plans that restore solvency by slowing benefit growth or with a balance of revenue and spending options. On top of that, many of the choices are framed in fashions that are not parallel with each other, likely leading participants to favor certain choices over others.

While we certainly appreciate NASI Board Chair Bill Arnone’s explanation of why NASI made some of the choices they did, the explanation unfortunately does not justify their decisions. For example, we know of no plan that would means-test benefits as NASI describes by literally requiring people to “provide proof of their eligibility” by proving their annual income (the Heritage plan NASI cites – one of the few to means-test based on current earnings at all – instead phases out benefit for the highest earning seniors and appears to do so based on already-reported taxable income). Whether Americans want to turn Social Security into a welfare program is not a good proxy for whether they support the much more often discussed approach to gradually slow the growth of initial benefits for those with higher lifetime earnings.

Separate from that issue, any evenhanded survey should offer all proposals’ best arguments – or at least provide parallel descriptions for similar proposals – rather than omitting views that are not held by the survey authors; this is especially true when those views are widely held within the expert community as is the case with Chained CPI (http://crfb.org/document/measuring-case-chained-cpi). Finally, fair descriptions of different options must describe their impact on benefits and taxes in comparable ways.

While we do have some concerns about the survey’s specifics, it would be a huge shame to throw the baby out with the bathwater. NASI plays an incredibly important role in bringing together experts, ideas, and solutions on issues related to social insurance. Bringing the public into this discussion through surveys and trade-off analyses is an incredibly important endeavor.

To that end, we propose that NASI and CRFB work together to develop an improved survey and trade-off analysis next year. We could work together to develop the questions, descriptions, and policy options that could help us best understand both what the American people prefer and what – in the right circumstances – they are willing to accept.

We are both non-partisan, respected groups – NASI more focused on social insurance and CRFB on fiscal issues – so questions and descriptions vetted by both organizations could remove any perception of bias.

The results would be incredibly informative to Democrats and Republicans interested in making sure the Social Security program is able to fully pay benefits well into the future. With the SSDI trust fund less than two years from running out of reserves, and the Old Age trust fund facing insolvency within two decades, time is running out to make thoughtful reforms.