By: Bethany Cole

Published: July, 2020

Overview

The COVID-19 pandemic has shocked the U.S. health care system. With the highest unemployment rates since the Great Depression, millions of Americans have lost employer-sponsored health insurance. Since the beginning of the pandemic, visits to primary care physicians and outpatient specialists have declined, and many hospitals have postponed or cancelled elective procedures. Meanwhile, some hospitals have seen a surge in patients and have had to expand capacity and purchase expensive personal protective equipment.

The COVID-19 pandemic has shocked the U.S. health care system. With the highest unemployment rates since the Great Depression, millions of Americans have lost employer-sponsored health insurance. Since the beginning of the pandemic, visits to primary care physicians and outpatient specialists have declined, and many hospitals have postponed or cancelled elective procedures. Meanwhile, some hospitals have seen a surge in patients and have had to expand capacity and purchase expensive personal protective equipment.

These trends have compounded problems in a fragmented U.S. health care system that has persistent gaps in access to affordable coverage and care, especially for people of color. In addition to the current decline in health coverage and increased financial strain on providers, the pandemic is likely to have long-term effects on the cost, quality, and access to care in the United States. COVID-19 legislation has attempted to address the short-term negative impacts on patients and providers; however, the legislative provisions are temporary and do not fully address the long-term impact COVID-19 is likely to have on the U.S. population and health care system. This brief examines the pandemic’s current and projected future impact on the health care system and discusses possible policy options to maintain and improve access to care.

Unemployment and Health Insurance

Current Trends

Prior to the pandemic, the U.S. already faced the challenge of persistent gaps in access to affordable, high-quality health coverage and care. According to the U.S. Census, approximately 8.5 percent of the population, or 27.5 million people, were uninsured at some point during 2018. The risk of being uninsured varies significantly by race/ethnicity and income. In 2018, non-Hispanic white people had an uninsured rate of 5.4 percent compared to 6.8 percent for Asian people, 9.7 percent for Black people, and 17.8 percent for Hispanic people of any race. 13.8 percent of individuals in households making less than $25,000 a year did not have health insurance compared with 3.2 percent of households making $150,000 a year or more (Berchick, Hood, and Barnett 2019).

Employer-sponsored health insurance (ESI) is the largest source of health coverage for Americans, with 67.3 percent of the population, or about 178 million people, having employer-sponsored coverage in 2018 (Berchick, Hood, and Barnett 2019). ESI provides coverage for a majority of the population, but it is especially vulnerable during times of economic crisis when workers lose their jobs. At the end of April 2020, the unemployment rate hit 14.7 percent, the highest official recorded rate since World War II. Due to the resumption of some economic activity, the unemployment rate dropped to 13.3 percent at the end of May and 11.1 percent at the end of June. The June unemployment data were collected before COVID-19 cases began to spike in states across the country and as a result, many states are currently pausing or rolling back reopening plans. The pandemic and resulting economic downturn are likely far from over and may have longer-lasting impacts on unemployment.

As workers continue to lose their jobs or are unable to regain employment, millions have lost and will continue to lose access to ESI. Some of these workers will qualify for Medicaid or will purchase coverage on the Affordable Care Act (ACA) individual markets, but others will be unable to gain new health insurance and will become uninsured. Researchers at the Urban Institute found that with an unemployment rate of 15 percent, approximately 17.7 million people could lose access to their ESI coverage. Of these, 8.2 million (46 percent) could gain Medicaid coverage, 4.4 million (25 percent) could gain coverage through the ACA individual market or other private insurance plans, and 5.1 million (29 percent) will likely become uninsured (Garrett and Gangopadhyaya 2020).1 Unfortunately, some people who lose access to ESI may not realize they are eligible for Medicaid or subsidized ACA individual market coverage, thus potentially increasing the share of the population that is uninsured beyond these estimates. This is especially critical to address during the pandemic because people who are uninsured are at risk of incurring significant costs for COVID-19 related testing and treatments.

COVID-19 Legislative Response

In order to facilitate the transition of workers who have lost ESI coverage to Medicaid coverage, under the Families First Coronavirus Response Act, Medicaid programs are eligible to receive a 6.2 percentage point increase in their Federal Medical Assistance Percentages (FMAP) from the federal government. States are eligible for this increase if they do not implement higher premiums or more restrictive eligibility requirements, allow continuous eligibility through the end of the month of the emergency period, and do not have cost-sharing requirements for coronavirus testing and treatments (Cole 2020). Additionally, Medicaid programs may elect to cover COVID-19 testing services for uninsured individuals, and states that do so will receive a 100% FMAP match for the duration of the public health emergency period. The bill also authorizes $1 billion for the National Disaster Medical System to pay for tests/diagnostics for coronavirus for uninsured individuals, with the U.S. Department of Health and Human Services (HHS) responsible for determining and paying claims.

Medicaid programs are a significant portion of state budgets, and spending is expected to significantly increase. According to research from the Kaiser Family Foundation, four in ten states with Medicaid spending projections (13 of 33) reported an expected Medicaid budget shortfall for FY 2021 (Rudowitz and Hinton 2020). Increases in the FMAP to help fund state Medicaid programs are only for the duration of the emergency period. State economies are not likely to have recovered at the end of the emergency period and will likely need additional relief to protect low-income individuals from the devastating financial and health impacts of COVID-19.

The Coronavirus Aid, Relief, and Economic Security (CARES) Act includes $150 billion in a Coronavirus Relief Fund that states and local governments with populations over 500,000 can utilize to mitigate the negative economic impacts of the COVID-19 outbreak. Although this provides much-needed relief for state budgets, it will likely not be enough because the financial impacts of the economic downturn are projected to be longer-lasting. The Congressional Budget Office currently projects the unemployment rate to decline somewhat at the end of 2020 but remain around 9 percent at the end of 2021 (Swagel 2020).

Impacts on Access to Health Care

As noted above, 17.7 million people could lose access to their ESI coverage if the unemployment rate is 15 percent (Garrett and Gangopadhyaya 2020). An estimated 71 percent would regain coverage through Medicaid, the ACA individual market, or other private coverage. However, if over 5 million people are left uninsured during the pandemic and economic downturn, access to health care could decline significantly. Having health insurance coverage makes people significantly less likely to delay seeking care when symptoms emerge, which is important for early detection and effective treatment for COVID-19. Without coverage, many patients may delay seeking care until their conditions worsen and require hospitalization. Health insurance is also important for the management of chronic conditions that could deteriorate without continuity in access to appropriate care. To-date, none of the COVID-19 response legislation requires public or private insurance programs to cover treatment costs for uninsured individuals, leaving them in grave financial risk if hospitalized.

The high unemployment rate is impacting health coverage for all workers, but unemployment and the risk of losing ESI coverage varies considerably by race, gender, and location.

Variation by Race and Gender

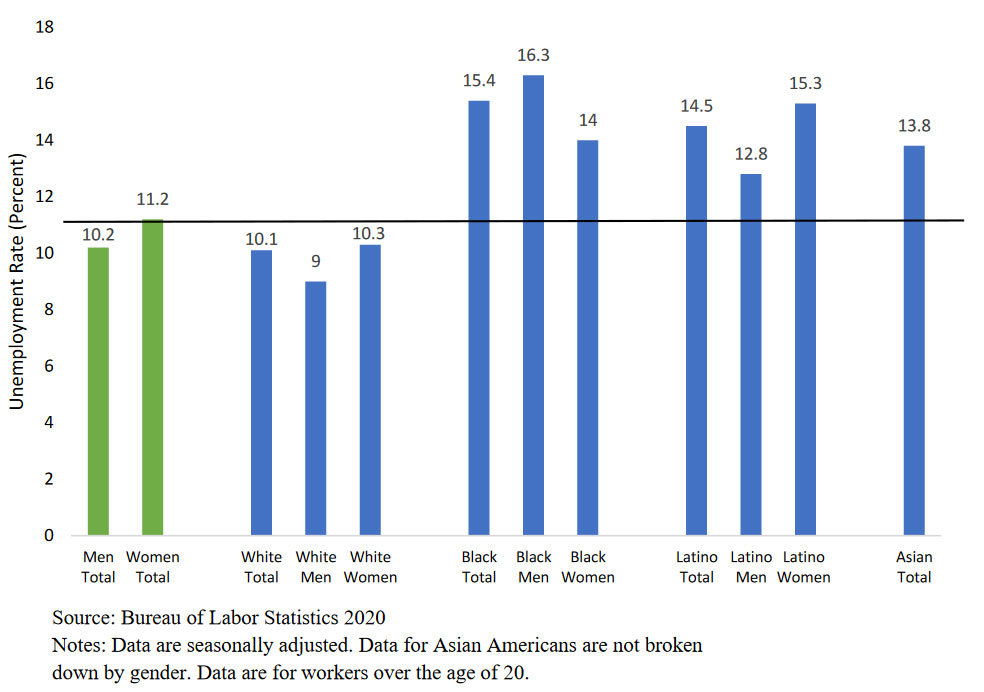

As shown in Figure 1, the unemployment rate varies considerably by race and gender. Unemployment for white adults fell from 12.4 percent in May to 10.1 percent in June, which was lower than the national average of 11.1 in June. Unemployment rates for Latino workers also declined from 17.6 population but 22.4 percent of COVID-19 deaths (Gould and Wilson 2020).

percent to 14.5 percent in June. For Black workers, the unemployment rate declined from 16.8 percent in May to 15.4 percent in June, and for Asian workers, the unemployment rate declined from 15 percent in May to 13.8 percent in June. For White, Black, and Latino workers, the unemployment rate is higher for women than men.

Figure 1: Unemployment Rate by Race and Gender, June 2020

The COVID-19 crisis underscores the consequences of longstanding and pervasive structural inequities in the United States. People of color have a higher unemployment rate than the national average and are at a higher risk of losing their ESI. This may further increase the current racial disparities in the share of the population that is uninsured and the inequitable access to health coverage and care, likely exacerbating the current disproportionate suffering of people of color during the pandemic and beyond. For example, as of mid-May 2020, Black people comprise 12.5 percent of the U.S.

Variation by State

Although all states will likely see high unemployment rates during the COVID-19 pandemic and recovery, there is considerable variation in the unemployment rate across states. Within states, the share of unemployed workers who become uninsured depends on the availability of Medicaid coverage and the affordability of ACA individual market coverage. In states that have expanded Medicaid under the ACA, about 53.4 percent of those losing ESI coverage will enroll in Medicaid compared to 33.4 percent in non-expansion states. Workers who have lost access to ESI in non-expansion states are more likely to become uninsured and face barriers accessing care. In expansion states, about 23 percent of those people losing ESI will become uninsured compared to 40.2 percent in non-expansion states (Garrett and Gangopadhyaya 2020).

Hospitals and Physician Practices

Current Trends

Costs for COVID-19 testing and treatment are significant for patients and insurers. Analysis of spending on treatment for respiratory diseases by large employer plans found that hospitalization costs exceeded $20,000 for pneumonia patients with complications, and for those that require ventilators, costs can exceed $80,000 (Cox, Kamal, and McDermott 2020). While utilization and spending on COVID-19 testing and treatment is high, many hospitals and physician practices are deferring elective and preventive visits to reduce the risk of coronavirus transmission between patients and providers. Recent research (Mehrotra et al. 2020) has found that the number of visits to ambulatory care practices had declined by almost 60 percent by early April compared to pre-pandemic numbers.2 As parts of the country began re-opening in May 2020, in person visits to ambulatory care practices rebounded, but were still one-third lower than before the pandemic (Mehrotra et al. 2020).

In addition to the high cost of COVID-19 treatment, hospitals are also facing significant financial challenges due to the reduction in outpatient services and deferment of elective procedures and surgeries. Elective procedures and surgeries are some of the most profitable services for hospitals, especially orthopedic and cardiac surgical procedures (Khullar, Bond, and Schpero 2020). In 2018, 37 percent of spending by private large employer plans was on non-emergency elective surgical procedures (Cox, Kamal, and McDermott 2020). While hospitals may have higher hospital and intensive care unit occupancy due to the pandemic, data indicate that health systems tend to lose about $1,200 per COVID-19 case and up to $6,000-$8,000 per case for some systems depending on payor mix (FAIR Health 2020). The actual impact varies considerably by hospital type, size, and location (FAIR Health 2020). As of June, some hospitals have begun offering elective procedures and surgeries; however, it is unclear if procedures have returned to pre-pandemic levels.

As in-person visits to physician practices declined, telehealth visits increased rapidly, rising from close to zero percent of total visits in early March 2020 to a peak of 14 percent in mid-April and plateauing at 12 percent in May (Mehrotra et al. 2020). While the increase in telehealth visits has somewhat combated the decline in in-person visits, physician practices are still facing significant financial challenges. According to an April survey, independent medical practices have reported a 55 percent decrease in revenue since the beginning of the pandemic (Medical Group Management Association 2020). Many of the practices surveyed had already laid-off or furloughed staff in response to the financial burden of COVID-19, and many that had not already done so might consider doing so if low-patient volumes continue. This financial challenge is especially difficult for small independent physician practices, which are a sizable portion of the health care workforce. More than half of physicians work in practices with 10 or fewer physicians (Slavitt and Mostashari 2020).

Nursing homes and skilled nursing facilities have been severely impacted by the pandemic. By early-May 2020, 28,000 nursing home residents and staff had lost their lives due to COVID-19 (Werner, Hoffman, and Coe 2020). Nursing homes had been ill-equipped to contain the spread of the virus, lacking adequate personal protective equipment and COVID-19 testing. In addition to the lack of adequate resources, nursing homes and facilities provide care to particularly vulnerable groups of people who are high risk for severe COVID-19 illness. Due to the lack of resources and risk of infection, many patients are choosing to receive care in other settings. Since the beginning of 2020, skilled nursing facilities have experienced up to a 6 percent decline in the patient population, which adds to their current financial strain (U.S. Department of Health & Human Services 2020).

COVID-19 Legislative Response

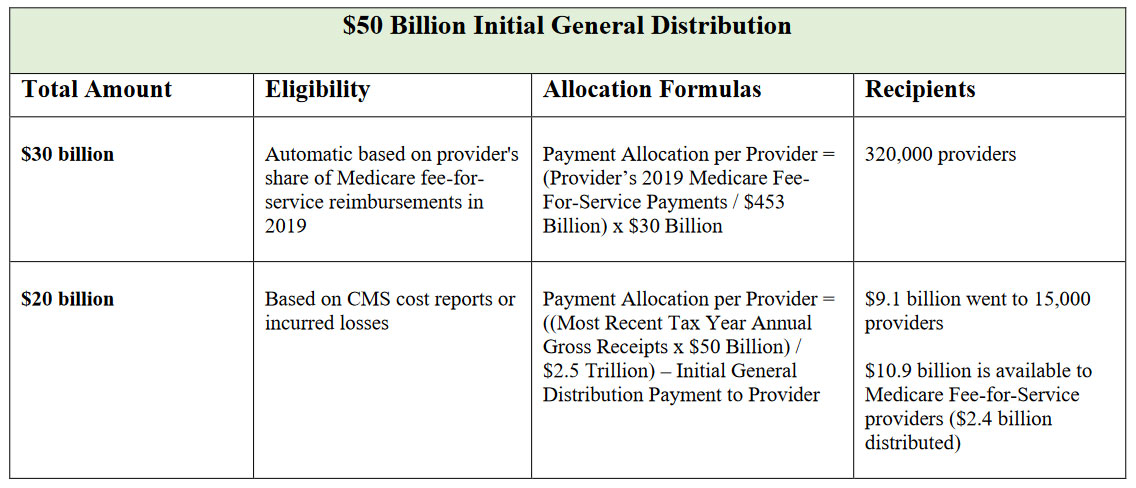

In response to the financial challenges facing hospitals and other providers, the CARES Act, the Paycheck Protection Program, and the Health Care Enhancement Act allocated a combined $175 billion in grants under the Provider Relief Fund to health care providers for the costs related to treating COVID-19 patients or to offset lost revenue due to the pandemic (Schwartz and Damico 2020). As of mid-June 2020, HHS has allocated approximately $102.4 billion of the Provider Relief Fund, of which $68.9 billion has been disbursed to providers. Table 1 provides additional information on the general and targeted allocations of the Provider Relief Fund.

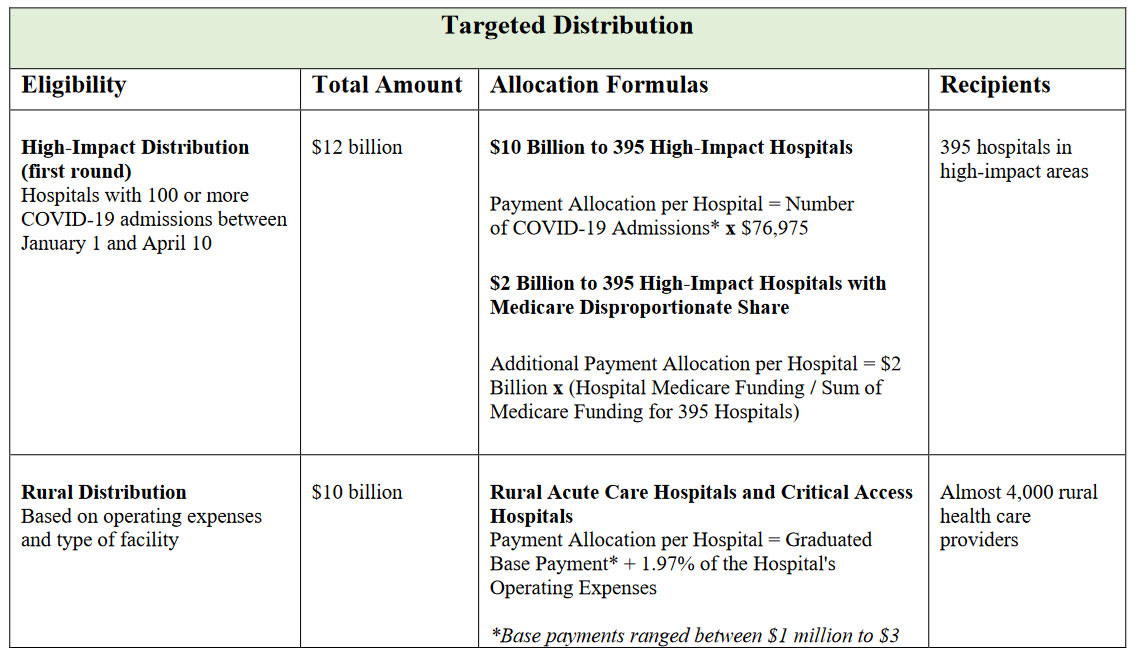

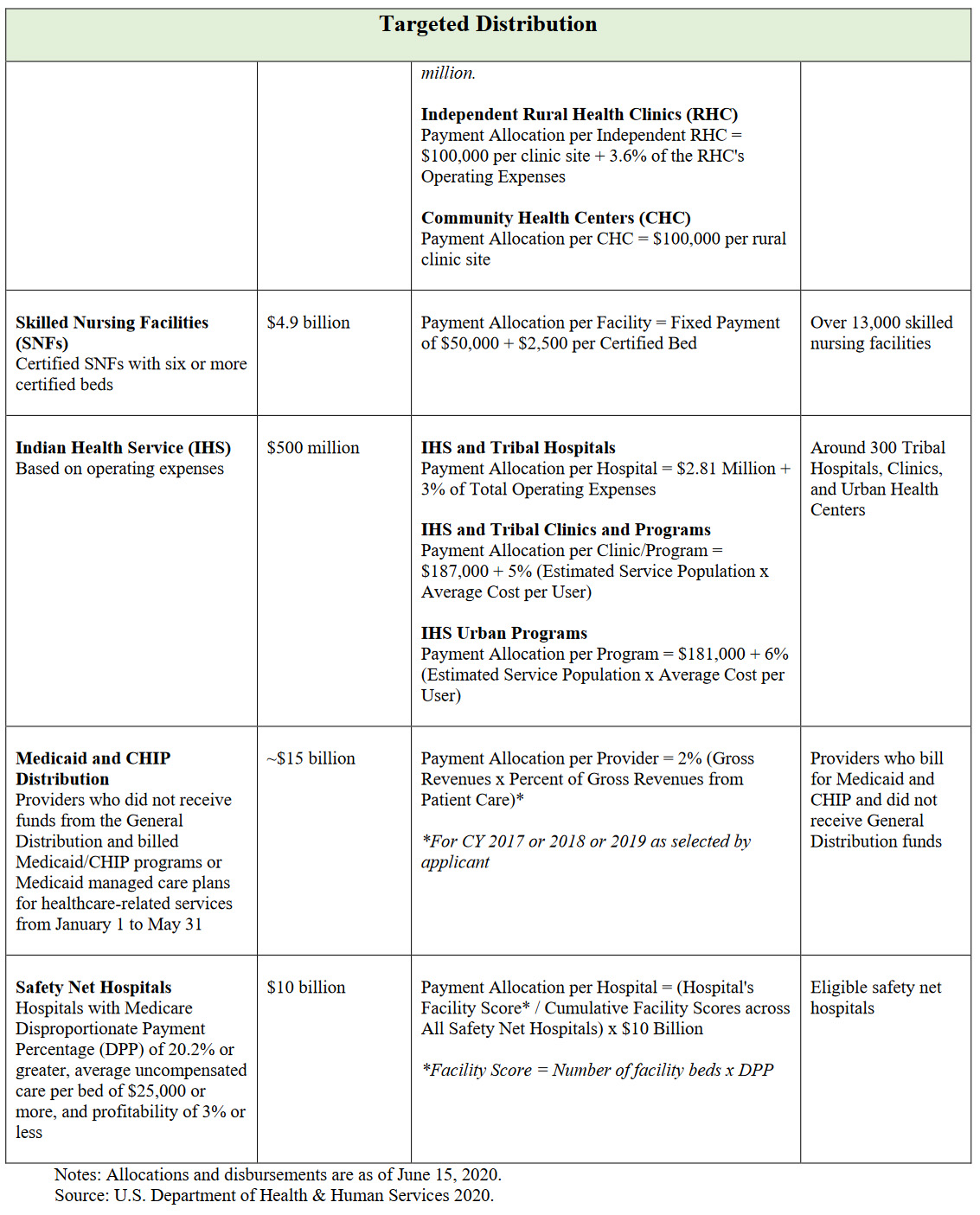

Table 1: Provider Relief Fund Allocations

The first $50 billion of the Provider Relief Fund was allocated to providers with Medicare fee-for-service reimbursements, given the higher risk of COVID-19 for seniors and people with disabilities and chronic conditions. The first $30 billion of this disbursement was based on the provider’s share of Medicare fee-for-service reimbursements in 2019, meaning that providers who serve a high volume of Medicare patients received a greater portion of the funds. Providers who serve a high volume of Medicaid patients instead of Medicare patients, such as pediatricians and obstetricians, substance abuse disorder treatment and community-based services and behavioral health services, were left-out of receiving this funding. The additional $20 billion for Medicare fee-for-service providers is based on CMS cost reports or incurred losses, so larger hospitals and providers received a greater proportion of disbursed funding. About 38 percent of providers across the country who participate in state Medicaid/CHIP programs did not receive any funds from the allocated portions of the $50 billion initial general disbursements (Coughlin, Ramos, Blavin, and Zuckerman 2020). These providers who did not receive funds from the initial general distribution and billed Medicaid/CHIP programs will be eligible for a targeted distribution of about $15 billion.

Recent research from the Kaiser Family Foundation found that for the $50 billion allocated to Medicare providers (including hospitals, skilled nursing facilities, and physicians), the disbursement of funds favored large hospitals. Hospitals with the highest share of private insurance revenue received $44,321 per hospital bed, while hospitals with the lowest share of private insurance revenue received an average of $20,710 per hospital bed (Schwartz and Damico 2020). Hospitals with the highest share of private insurance tended to be larger, have higher operating margins and provide less uncompensated care, and hospitals with the lowest share of private insurance revenue tend to serve more Medicaid and Medicare patients (Schwartz and Damico 2020).

As the disbursement allocations did not take into account the size or underlying financial security of providers, including hospital reserves and assets, larger hospitals with more market power that were in a better position to handle the decline in revenue from the start, received a larger share of the Provider Relief Fund. Researchers found that hospitals with lower financial liquidity and therefore higher financial vulnerability, were more likely to be small, rural, have critical access status, and have lower occupancy rates.3 Hospitals with high liquidity and therefore higher financial security, were more likely to be nonprofit hospitals, teaching hospitals, and affiliated with larger health systems (Khullar, Bond, and Schpero 2020). For example, Providence Health System received $509 million in government funds, while having nearly $12 billion in investments that generate over $1 billion in profits each year (Drucker, Silver-Greenberg, and Kliff 2020).

Rural hospitals, including Rural Acute Care Hospitals and Critical Access Hospitals, Independent Rural Health Clinics, and Community Health Centers, were eligible for funds from the $10 billion targeted rural disbursement (U.S. Department of Health & Human Services 2020). This disbursement was based largely on operating expenses, leading to higher payments for larger institutions with higher operating costs. Similar to the $50 billion general disbursements, the formulas for the rural disbursement did not take into account any hospital reserves or assets, or whether the rural hospitals were associated with larger health systems and therefore had greater underlying financial security.

“Safety-net” hospitals disproportionately serve a high volume of Medicaid patients and those without health insurance. Many safety-net hospitals have negative profit margins and are at a higher risk of closure due to COVID-19 than other hospitals. An additional $10 billion will be disbursed to safety-net hospitals that have a Medicare Disproportionate Payment Percentage (DPP) of 20.2 percent or greater, an average uncompensated care per bed of $25,000 or more, and profitability of 3 percent or less (U.S. Department of Health & Human Services 2020).4 Medicare Disproportionate Share Hospitals (DSHs) that have a DPP of between 15 and 20.2 percent that qualify for payment adjustments, may be left out of receiving these targeted funds, but may receive payments under the Medicaid and CHIP or general disbursements (Medicare Learning Network 2019).

A total of $12 billion of the Provider Relief Fund was disbursed to 395 hospitals that had 100 or more COVID-19 admissions between January 1st and April 10th, 2020. This first round of high-impact distributions may have left out smaller hospital facilities that treated a high share of COVID-19 patients in their area but were too small to meet the 100-patient requirement for funds. Additionally, hospitals that met the 100-patient threshold after April 10th have not yet received funds from the Provider Relief Fund. HHS has announced $10 billion in funds for a second round of targeted High-Impact Distribution to hospitals (Coughlin, Ramos, Blavin, and Zuckerman 2020). To be considered for this second round of funding, hospitals can update their number of COVID-19 positive inpatient admissions between January 1st and June 10th, 2020 (U.S. Department of Health & Human Services 2020).

Some physician practices may have received money from the current payout of the Provider Relief Fund and/or have applied for small business loans from the Paycheck Protection Program and Economic Injury Disaster Loans. The small business loans could provide additional emergency revenue for those that received little or no payouts from the disbursement of the CARES Act funds. However, those programs have been incredibly difficult for small businesses to access (Slavitt and Mostashari 2020). Under the CARES Act, physician and other providers are eligible for advanced payments for Medicare, which could equal up to 100 percent of the Medicare payment amount for a previous three-month period (American Medical Association 2020). However, physicians that serve a low volume of Medicare patients receive less money through these mechanisms, and physicians must start paying back advances 120 days after the issuance of the payment (American Medical Association 2020). Even with these funding opportunities, it is likely that many physician practices, especially small practices, providers in specialties that do not serve a high amount of Medicare patients, or in rural and underserved areas, are still financially struggling.

Impacts on Access to Care

The deferment of elective procedures and preventive care is tough on both providers and patients. Although elective procedures are classified as not urgent, they may still be lifesaving or greatly improve the quality of life for patients who are suffering from acute and chronic conditions. Researchers have estimated that at the conclusion of the COVID-19 crisis, there could be at least a 3-month backlog of surgery, which will further impact access to care and health outcomes for patients (Fu et al. 2020). As of late-April, there was a steep decrease in the number of cancer screenings relative to pre-pandemic numbers. The average weekly screenings for breast, colon,

and cervical cancers dropped 94 percent, 86 percent, and 94 percent, compared to the average in January 2020 (Cox, Kamal, and McDermott 2020). The decline in access to preventive care and elective surgeries may affect long-term health outcomes and health care spending.

In an effort to maintain access to care and combat the spread of COVID-19, providers are transitioning to telehealth; insurers are waiving copayments for virtual visits; and Medicare is compensating providers for virtual visits (Velasquez and Mehrotra 2020). As discussed earlier, the rise in telehealth visits has combatted some of the decline in access to care, but not enough to fully offset the decline in in-person visits. Telehealth does not allow for physical exams or lab tests that are necessary for many appointments. Additionally, there are significant gaps and barriers in access to telehealth services due to lack of access to technology, digital literacy, and reliable internet coverage (Velasquez and Mehrotra 2020). This inequitable access disproportionally impacts older people of color, people of low socioeconomic status, and rural communities at a time when older individuals and communities of color are at higher risk of serious COVID-19 health complications (Velasquez and Mehrotra 2020). A significant percent of physician office visits could be handled via telemedicine. However, it is unclear whether physicians will continue to be reimbursed for telemedicine visits after the public health emergency ends (Rubin 2020).

Potential Long-Term Impacts on Access to Health Care

The intertwined trends of high rates of unemployment, loss of insurance, and the deferment of elective procedures and preventive care have increased financial strains on providers, state budgets, and Medicaid programs. This has led to significant reductions in access to care for millions of Americans, especially for communities of color and rural communities. Although the pandemic will eventually subside and the economy will recover, COVID-19 is likely to have long-term effects on cost, quality, and access to care in the United States.

Provider Closures

The financial impact could be dire for rural hospitals (especially critical access hospitals), safety-net hospitals, nursing homes and skilled nursing facilities, and smaller independent physician practices that may have received little or no payments from the disbursements of the Provider Relief Fund. Prior to the COVID-19 pandemic, 1 in 5 rural hospitals were at risk of closure due to financial difficulties (Khullar, Bond, and Schpero 2020). Skilled nursing facilities received a disbursement of $4.9 billion from the Provider Relief Fund; however, this amount is unlikely to sustain skilled nursing facilities through the remainder of the pandemic, and no targeted relief has been provided to traditional nursing homes, although some nursing homes may have received funds through Medicare disbursements and could receive funds from the upcoming Medicaid and CHIP disbursement.

Additionally, the Provider Relief Fund disbursements were a one-time payment and many rural and safety-net hospitals will likely experience financial vulnerability throughout the remainder of the pandemic and economic downturn. Without adequate funding support, some rural hospitals, nursing homes and skilled nursing facilities, and safety-net hospitals are at risk of having to close over the long-term. This would further reduce access to care for communities of color and rural communities that already face barriers in access to health coverage and care.

Primary care physicians received a share of the first disbursements from the Provider Relief Fund; however, the typical primary care physicians received only enough to keep their practice open for a single week (Slavitt and Mostashari 2020). Some physicians also received advances from Medicare, but those advances will need to be paid back in full starting this summer, well before most practices will be financially secure (Slavitt and Mostashari 2020). New funding of $15 billion will be disbursed to eligible providers who participate in state Medicaid and CHIP programs that have not received a payment from the initial allocations (U.S. Department of Health & Human Services 2020). This assistance will be helpful for small independent physician practices; however, they will be competing for the money against larger organizations, including physician practices affiliated with health systems, assisted living facilities, and other home and community-based services providers.

Spending and Costs

Private health insurers and government programs could face increases in health care costs beyond the duration of the pandemic. The high cost of COVID-19 testing and treatment is putting upward pressure on health care costs, but the actual impact is still unclear as it depends on the duration and severity of the pandemic, the extent of public health efforts, and any potential policy changes. Although costs are high for COVID-19 treatment, the delaying and forgoing of care is putting downward pressure on other costs during this year and likely through the remainder of the pandemic; however, once levels of utilization begin rising, costs could increase in future years. This could be exacerbated by potential worsened health outcomes due to the delay in care during the pandemic, which can increase future spending (Cox et al. 2020). Rising costs put additional financial pressure on private insurers and government insurance programs, which can alter access to care for enrollees.

Private Insurance

In the coming weeks, commercial insurers must submit their 2021 premium amounts to state insurance regulators for approval. Insurers cannot base their premiums on losses they expect this year; instead they must base premiums on the expected claim costs for 2021. Once their premiums are approved in late summer, those rates are locked in and are not able to be altered for the duration of the next calendar year (Cox et al. 2020). COVID-19 has made the premium setting process challenging and uncertain for private insurers. This may cause private insurers not to offer coverage next year or to over-price their plans for 2021, which could then lead to higher premium prices in private markets as well as in the ACA individual market where many people are turning for coverage during the pandemic. In some areas of the country, particularly rural areas, there are few insurers offering coverage on the ACA individual market, a situation which could be exacerbated if insurers decide not to offer coverage in 2021 (Cox et al. 2020).

In addition to the current challenge of estimating claims and setting premiums for 2021, private insurers may also face rising costs over the long term. As hospitals and other providers face financial challenges due to COVID-19, they have an incentive to increase the payment rates from private insurers to increase revenues. Large hospitals and health care systems in highly consolidated markets are able to negotiate rates from private insurers that are considerably higher than the rates paid by Medicare (Berenson et al. 2020). If the financial pressure from COVID-19 encourages further provider consolidation, especially “vertical” mergers of hospitals and physician groups and the development of large hospital systems that cross geographic areas, this could further drive the upward pressure on payment rates for private insurers.

Medicare and Medicaid

COVID-19 related treatment costs will likely put upward pressure on Medicare spending, but this impact could be balanced out by the decrease in spending on delayed or forgone elective procedures and office visits; however, spending on telehealth services may offset part of this decline. Medicare spending could increase in the long term as there will likely be a pent-up demand for elective procedures and office visits, which could be rescheduled for later in the year or shifted to next year. The rise in spending in traditional Medicare could increase the Medicare Advantage payment benchmarks, which would increase payments to Medicare Advantage, further increasing overall Medicare spending (Cox et al.2020). Medicare’s premium and cost-sharing requirements are calculated based on expected program costs, which would increase if Medicare spending rises during the pandemic and beyond. This would reduce access to care for Medicare beneficiaries, especially for uncovered services and for people without supplemental coverage.

Medicaid is critical for protecting low-income individuals from devastating financial and health impacts during economic downturns with high unemployment rates. Medicaid program costs are expected to increase due to higher enrollment from people losing their ESI and from the high cost of COVID-19 treatment. A significant portion of Medicaid spending is not easily deferred, such as care for older low-income individuals and people with disabilities, including long-term services and supports (Cox et al. 2020). The current increase in spending combined with a decline in revenue is contributing to the current and potential future strain on state budgets. Although legislation has increased the FMAP for Medicaid programs with maintenance of effort requirements and provided emergency funding for states and localities, those actions are temporary and will likely not suffice through the remainder of the pandemic and economic downturn. Additionally, during an economic recovery following a recession, employment growth tends to lag behind general economic growth, so individuals who obtained Medicaid during the pandemic may not return to private insurance until well after the end of the pandemic and economic recession (Medicaid and CHIP Payment Access Commission 2020).

During economic downturns, states often face reductions in revenue due to reduced sales and income tax collections. In previous recessions, states have frozen or even cut provider payment rates and implemented targeted benefit or eligibility restrictions to reduce costs, but those actions are not viable during a pandemic (Cox et al. 2020). Without the certainty of additional funding, many states will need to create balanced budgets for the next fiscal year (starting on July 1, 2020 for most states) that could include Medicaid spending cuts, which would further decrease access to care for vulnerable groups during a health and economic crisis (Rudowitz and Hinton 2020).

Policy Options

During the pandemic and economic recovery, a range of additional steps are available to policymakers to improve current and future access to care for individuals and communities. These include increasing financial resources for Medicaid programs and state budgets and implementing targeted support for providers.

Increasing Funding for State Budgets and Medicaid

The Families First Coronavirus Response Act increased funding for state Medicaid programs to address the financing needs from increased enrollment during the pandemic. However, many states still have barriers that restrict Medicaid enrollment such as work requirements. States can implement a range of policies under existing rules to increase access to Medicaid coverage and health care in response to the COVID-19 pandemic. For example, states might allow self-attestation of eligibility criteria (other than citizenship and immigration status) with verification of income post-enrollment. States might also submit a state plan amendment (SPA) that could expand eligibility in a variety of ways including, adopting presumptive eligibility, modifying benefit and cost-sharing requirements, and providing 12-month continuous eligibility for children (Brooks et al. 2020).

Although the legislation included a 6.2 percentage point increase in the FMAP to help fund state Medicaid programs and allocated $150 billion emergency fund for states and local governments, these increases in funding are only for the duration of the public health emergency period. The Medicaid and CHIP Payment Access Commission estimates that states will need between a 6 to 12 percentage point increase in the FMAP under the low enrollment growth scenario and an 8 to 14 percentage point increase under the medium enrollment scenario for Fiscal Year 2020. For Fiscal Year 2021, most states would need between a 4 to 10 percentage point increase in the FMAP under the low enrollment growth scenario and an 8 to 14 percentage point increase under the medium enrollment scenario. Under the low enrollment scenario, the 6.2 percentage point increase in the FMAP in the COVID-19 response legislation would be enough to for some states to sustain their Medicaid programs through 2021. However, the FMAP increase would not be enough for some states under the low-growth scenario and not enough for all states under the medium-growth scenario in FY 2020 and 2021 (MACPAC 2020).

Medicaid programs are an effective vehicle to support local health care providers during COVID-19. States could implement a variety of policies to quickly and effectively increase revenue to providers, especially local safety-net, long-term care, and rural providers. These could include increasing payment rates for COVID-19 testing and treatment or making advance payments or interim payments for providers based on historic claims (Cox et al. 2020).

In order to ensure that states do not implement cuts to Medicaid programs next fiscal year, policymakers could further increase FMAP beyond 6.2 percentage points and consider keeping the FMAP high after the public health emergency period. Policymakers could also provide additional state funding to encourage states to further expand their Medicaid services, such as increasing testing and vaccinations for Medicaid enrollees and the uninsured. Federal policymakers could consider additional funding for state Medicaid programs to implement payment policies to support their local health care providers. As a condition for increased FMAP, federal legislation could also include incentives for states to adopt or immediately implement the ACA expansion of Medicaid to low-income adults.

As many Americans across the country are losing their jobs and/or employer-sponsored health coverage, those who do not qualify for Medicaid in their states are turning to the ACA individual market for health coverage. However, provisions to strengthen the ACA individual market were left out of COVID-19 response legislation. Before the COVID-19 outbreak, the ACA individual markets were already facing premium affordability issues for many consumers, especially those who do not qualify for premium tax credits. Due to the challenges and uncertainty in premium setting, some private insurers may not offer coverage next year or might over-price their plans for 2021 (Cox et al. 2020). Policymakers could implement a number of proposals to strengthen accessibility and affordability of private insurance plans in the ACA individual markets, including expanding enrollment periods and premium subsidies and implementing federal reinsurance or emergency risk mitigation programs to keep insurer costs and premiums down.

Support for Providers

As of mid-June 2020, HHS had allocated approximately $102.4 billion of the $175 billion Provider Relief Fund, of which $68.9 billion has been disbursed to providers; however, the disbursement allocations did not take into account the size or underlying financial security of providers and therefore favored larger hospitals. When determining the formulas to disburse future allocations to providers, policymakers could consider more targeted financial support, rather than formulas that only take into account current losses from reduced elective and outpatient procedures. Allocation formulas for funds could account for the ability of providers to recoup lost revenue with their current reserves and assets, as well as in the future once normal operations resume (Khullar, Bond, and Schpero 2020).

Rural and Safety-Net Hospitals

Although the Provider Relief Fund is important for supporting rural and safety-net providers, the disbursements were a one-time payment and many rural and safety-net hospitals are likely to experience this financial vulnerability throughout the remainder of the pandemic and economic downturn. Policymakers should consider ongoing targeted funding to rural and safety-net hospitals. Sustained targeted financial support will be essential for ensuring these institutions can survive the pandemic and keep serving vulnerable communities during the COVID-19 crisis and beyond. To stabilize rural hospital and clinic infrastructures, the Bipartisan Policy Center Rural Health Task Force recommends making certain rural hospital designations and payment adjustments permanent, allowing greater flexibilities around care delivery and coordination, strengthening the rural health care workforce, establishing new rural care transformation models, and furthering the transformation towards value-based care (Cassling 2020).

In an effort to maintain access to care and combat the spread of COVID-19, many providers are transitioning to telehealth and the federal government, many state governments, and commercial health insurers have expanded coverage of telehealth and virtual visits (Velasquez and Mehrotra 2020). Transitioning to telehealth during the COVID-19 pandemic limits provider and patient exposure and expands the available workforce. These benefits are especially critical in rural areas, where telehealth enables rural communities to access providers in areas without workforce shortages and allows individuals to receive care at home if they live far from health care providers (Cassling 2020).

Telehealth is likely to continue even after the pandemic is over and could benefit rural areas and providers. However, there are significant gaps and barriers in access to telehealth services due to lack of access to technology, digital literacy, and reliable internet coverage (Velasquez and Mehrotra 2020). Policymakers could consider investing in broadband in rural communities, providing funding for rural-specific training for the health IT workforce, removing restrictions on the types of devices that can be used for telehealth, expanding the list of authorized sites, and reducing the barriers of practicing telehealth across state lines (Cassling 2020). If increased demand for telehealth continues after the pandemic has subsided, federal and state policymakers need to reevaluate the non-public health emergency period level of coverage and amount that Medicare and Medicaid programs compensate telehealth providers.

Nursing Homes and Skilled Nursing Facilities

Although certified skilled nursing facilities with six or more certified beds received $4.9 billion from the Provider Relief Fund, traditional nursing homes were potentially left out of receiving these funds. Some nursing homes and assisted living facilities may receive funds from the upcoming Medicaid and CHIP disbursement of the Provider Relief Fund. Additionally, the $4.9 billion allocated to skilled nursing facilities is not likely to sustain these facilities through the duration of the pandemic. In a letter to HHS Secretary Alex Azar, Mark Parkinson of the American Health Care Association and National Center for Assisted Living requested a targeted disbursement of $10 billion for long-term care facilities, including nursing homes, skilled nursing facilities, and assisted living centers. This targeted funding for long-term care facilities will improve COVID-19 testing, increase the availability of personal protective equipment for workers, hiring of additional staff, and financially sustain these facilities through the pandemic (Parkinson 2020).

Policymakers could also consider broader options to improve long-term care in the U.S. beyond the pandemic. The demand for long-term care is expected to rise considerably as the population continues to age, and this trend could be further exacerbated by health consequences of COVID-19. Medicaid is the largest payer for long-term care services, and state budgets are likely to experience increased strain as long-term care demand increases. There has been a considerable shift towards providing long-term care in home and community-settings instead of traditional facilities, which could be furthered during the pandemic. In order to address this trend, Medicaid programs could invest in developing Home and Community-Based Services (HCBS) Waivers to pay for home and community-based long-term care (Werner, Hoffman, and Coe 2020).

Independent Physician Practices

As discussed previously, small independent physician practices have been largely left out of the Provider Relief Fund and the Paycheck Protection Program. As the country has begun to reopen, office visits have begun to resume, and community-based primary care practices will need to provide access to testing and treatment for mild COVID-19 cases and help prevent cases from turning into outbreaks, further straining hospitals and nursing homes. Additionally, because the management of chronic conditions was put on hold for several months, physician practices will need to provide necessary care for those with chronic conditions. Although revenue will increase as visits resume, physician practices may still face financial challenges from having to rehire and expand staff capacity and purchase personal protective equipment. The $15 billion allocated for Medicaid and CHIP providers will help many physician practices; however, they are competing for this funding against larger organizations, including physician practices affiliated with health systems, assisted living facilities, and other home and community-based services providers (Slavitt and Mostashari 2020).

To preserve small independent physician practices, policymakers could consider targeting future allocations of the Provider Relief Fund to small physician practices. Andy Slavitt and Farzad Mostashari (2020) have estimated that $15 billion could be enough to sustain practices. Slavitt and Mostashari also suggest that HHS consider transitioning the loans that practices have received from the Paycheck Protection Program into grants. For physicians who received advances from Medicare and need to pay back in full before their practices are financially secure, policymakers could consider removing or delaying the requirements to pay back the advances from Medicare within 120 days of issuance.

Conclusion

Prior to the pandemic, the U.S. already faced the challenge of persistent gaps in access to affordable, high-quality health coverage and care. Due to COVID-19 and the ensuing economic downturn, millions of Americans have and will continue to become unemployed and potentially lose access to their employer-sponsored health insurance. Although Medicaid and the ACA individual markets will provide a source of coverage for many recently unemployed individuals, many may become uninsured. In particular, those in non-Medicaid expansion states and people of color are disproportionately at risk of becoming uninsured due to COVID-19. Growth in Medicaid program enrollment increases the financial strain of the pandemic on state budgets, which could further reduce access to care.

Simultaneously, many hospitals have postponed or cancelled elective procedures, and visits to primary care physicians and outpatient specialists have declined since the beginning of the pandemic. The decline in health care utilization has put significant financial strains on providers, especially rural and safety-net hospitals and small independent physician practices.

The gaps in Provider Relief Fund disbursements could leave these providers at risk of having to layoff or furlough workers or eventually to close. Additionally, if large hospitals use this fraught period to purchase financially struggling physician and other provider offices, this could further increase provider consolidation and drive up prices for health care services. These factors put additional financial pressure on private insurers and patients, as well as on Medicare and Medicaid programs, which could further decrease access to care.

Policymakers can implement a variety of policies that increase health insurance coverage and support providers and health care systems to mitigate current and future reductions in access to health care as a result of the pandemic and economic downturn. These include increasing financial resources for Medicaid programs and state budgets, strengthening ACA individual markets, implementing more targeted federal funding based on provider need, and providing additional ongoing funding and supports for rural and safety-net hospitals and small independent physician practices.

References

American Medical Association. 2020. “CARES Act: Medicare advance payments for

COVID-19 emergency.” April 6. https://www.ama-assn.org/delivering-care/public-health/cares-act-medicare-advance-payments-covid-19-emergency

Berchick, Edward R., Emily Hood, and Jessica C. Barnett. 2019. “Health Insurance Coverage in the United States: 2018 Current Population Reports.” The United States Census Bureau. November. https://www.census.gov/content/dam/Census/library/publications/2019/demo/p60-267.pdf

Berenson, Robert, Jamie King, Katherine Gudiksen, Roslyn Murray, and Adele Shartzer. 2020. “Addressing Health Care Market Consolidation and High Prices.” The Urban Institute. January 13. https://www.urban.org/research/publication/addressing-health-care-market-consolidation-and-high-prices/view/full_report

Brooks, Tricia, Lauren Roygardner, Samantha Artiga, Olivia Pham, and Rachel Dolan. 2020. “Medicaid and CHIP Eligibility, Enrollment, and Cost Sharing Policies as of January 2020: Findings from a 50-State Survey.” The Kaiser Family Foundation. March 26. https://www.kff.org/coronavirus-covid-19/report/medicaid-and-chip-eligibility-enrollment-and-cost-sharing-policies-as-of-january-2020-findings-from-a-50-state-survey/

Bureau of Labor Statistics. 2020. “The Employment Situation- June 2020.” July 2.https://www.bls.gov/news.release/pdf/empsit.pdf

Cassling, Kate. 2020. “Reforming Rural Health Care in the Era of COVID-19.” Bipartisan Policy Center. May 26.https://bipartisanpolicy.org/blog/reforming-rural-health-care-in-the-era-of-covid-19/?_cldee=YmNvbGVAbmFzaS5vcmc%3d&recipientid=contact-0d48e4d84844ea11922400155d3b3ccc- 3cc35402e7c44f759e7d7c150ae3791d&utm_source=ClickDimensions&utm_medium=email&utm_campaign=Project%

20Update%20%7C%20Health%20Project&esid=adb22fe5-9ca5-ea11-a812-000d3a1bb7bb

Cole, Bethany. 2020. “Fact Sheet: Medicare, Medicaid, and the Uninsured.” The National Academy of Social Insurance. April. https://www.nasi.org/research/covid-19-legislative-response/fact-sheet-medicare-medicaid-and-the-uninsured/

Coughlin, Teresa A., Christal Ramos, Fredric Blavin, and Stephen Zuckerman. 2020. “Federal COVID-19 Provider Relief Funds: Following the Money.” The Urban Institute. June 10. https://www.urban.org/urban-wire/federal-covid-19-provider-relief-funds-following-money?cm_ven=ExactTarget&cm_cat=HPC+- +6.30.2020&cm_pla=All+Subscribers&cm_ite=https%3a%2f%2fwww.urban.org%2furban-wire%2ffederal-covid-19-provider-relief-funds-following-money&cm_ainfo=&&utm_source=%20urban_newsletters&&utm_medium=news-HPC&&utm_term=HPC&&

Cox, Cynthia, Rabah Kamal, and Daniel McDermott. 2020. “How Have Healthcare Utilization and Spending Changed so Far during the Coronavirus Pandemic?” Peterson-KFF Health System Tracker. May 29. https://www.healthsystemtracker.org/chart-collection/how-have-healthcare-utilization-and-spending-changed-so-far-during-the-coronavirus-pandemic/#item-start

Cox, Cynthia, Robin Rudowitz, Tricia Neuman, Juliette Cubanski, and Matthew Rae. 2020. “How Health Costs Might Change with COVID-19.” Peterson-KFF Health System Tracker. April 15. https://www.healthsystemtracker.org/brief/how-health-costs-might-change-with-covid-19/

Department of Health & Human Services. 2020. “CARES Act Provider Relief Fund: General Information.” https://www.hhs.gov/coronavirus/cares-act-provider-relief-fund/general-information/index.html

Drucker, Jesse, Jessica Silver-Greenburg, and Sarah Kliff. 2020. “Wealthiest Hospitals Got Billions in Bailout for Struggling Health Providers.” New York Times. May 25. https://www.nytimes.com/2020/05/25/business/coronavirus-hospitals-bailout.html?searchResultPosition=1

FAIR Health. 2020. “Illuminating the Impact of COVID-19 on Hospitals and Health Systems.” May 12. https://s3.amazonaws.com/media2.fairhealth.org/brief/asset/Illuminating%20the%20Impact%20of%20COVID-19%20on%20Hospitals%20and%20Health%20Systems%20-%20A%20Comparative%20Study%20of%20Revenue%20and%20Utilization%20-%20A%20FAIR%20Health%20Brief.pdf

Fu, Sue, Elizabeth George, Paul Maggio, Mary Hawn, and Rahim Nazerali. 2020. “The Consequences of Delaying Elective Surgery: Surgical Perspective.” Annals of Surgery, April. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7224620/#

Gould, Elise, and Valerie Wilson. 2020. “Black Workers Face Two of the Most Lethal Preexisting Conditions for Coronavirus—Racism and Economic Inequality.” June 1. Economic Policy Institute. https://www.epi.org/publication/black-workers-covid/

Garrett, Bowen, and Anuj Gangopadhyaya. 2020. “How the COVID-19 Recession Could Affect Health Insurance Coverage.” The Urban Institute. May 4. https://www.urban.org/research/publication/how-covid-19-recession-could-affect-health-insurance-coverage

Institute for Patient- and Family-Centered Care n.d. “Defining Ambulatory Care.” https://www.ipfcc.org/bestpractices/ambulatory-care/defining-ambulatory-care.html

Khullar, Dhruv, Amelia Bond, and William Schpero. 2020. “COVID-19 and the Financial Health of US Hospitals.” JAMA 323 (21): 2121–28. https://jamanetwork.com/journals/jama/fullarticle/2765698

Medical Group Management Association. 2020. “COVID-19 Financial Impact on Medical Practices.” https://mgma.com/getattachment/9b8be0c2-0744-41bf-864f-04007d6adbd2/2004-G09621D-COVID-Financial-Impact-One-Pager-8-5×11-MW-2.pdf.aspx?lang=en-US&ext=.pdf

Medicaid and CHIP Payment Access Commission (MACPAC). 2020. “Considerations for Countercyclical Financing Adjustments in Medicaid.” June. https://www.macpac.gov/wp-content/uploads/2020/06/Considerations-for-Countercyclical-Financing-Adjustments-in-Medicaid.pdf

Medicare Learning Network. 2019. “Fact Sheet: Medicare Disproportionate Share Hospital.” Centers for Medicare & Medicaid Services. November. https://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNProducts/downloads/Disproportionate_Share_Hospital.pdf

Mehrotra, Ateev, Michael Chernew, David Linetsky, Hilary Hatch, and David Cutler. 2020. “The Impact of the COVID-19 Pandemic on Outpatient Visits: A Rebound Emerges.” The Commonwealth Fund. May 19. https://www.commonwealthfund.org/publications/2020/apr/impact-covid-19-outpatient-visits

New York Times. 2020. “Unexpected Drop in U.S. Unemployment Helps Markets Rally.” June 8.https://www.nytimes.com/2020/06/05/business/jobs-report-stock-market-coronavirus.html?action=click&module=Top%20Stories&pgtype=Homepage

Parkinson, Mark. 2020. “Request for $10 Billion in Additional Funding and Support for Long Term Care Facilities, including Nursing Homes and Assisted Living Communities, in Response to COVID-19 Pandemic.” American Health Care Association and National Center for Assisted Living. May 5.

https://www.ahcancal.org/facility_operations/disaster_planning/Documents/AHCA_HHSFEMA%20Letter_5.5.2020.pdf

Rubin, Rita. 2020. “COVID-19’s Crushing Effects on Medical Practices, Some of Which Might Not Survive.” JAMA, June 18. https://jamanetwork.com/journals/jama/fullarticle/2767633

Rudowitz, Robin, and Elizabeth Hinton. 2020. “Early Look at Medicaid Spending and Enrollment Trends Amid COVID-19.” The Kaiser Family Foundation. May 15. https://www.kff.org/coronavirus-covid-19/issue-brief/early-look-at-medicaid-spending-and-enrollment-trends-amid-covid-19/

Rural Health Information Hub. n.d. “Critical Access Hospitals (CAHs).” https://www.ruralhealthinfo.org/topics/critical-access-hospitals

Schwartz, Karyn, and Anthony Damico. 2020. “Distribution of CARES Act Funding Among Hospitals.” The Kaiser

Family Foundation. May 13. https://www.kff.org/health-costs/issue-brief/distribution-of-cares-act-funding-among-

hospitals/?utm_campaign=KFF-2020-Health- Costs&utm_source=hs_email&utm_medium=email&utm_content=87886305&_hsenc=p2ANqtz– 5H_dI5ybM9j7dEUcpNHIhhhSIhGZKuiOyCgdpPdMkmJ65llIkF9D8sYDfor_aNPAh8_2CoURE3ISuaDmzFepJuTo2F Q

Slavitt, Andy, and Farzad Mostashari. 2020. “Covid-19 Is Battering Independent Physician Practices. They Need Help Now.” STAT, May 18. https://www.statnews.com/2020/05/28/covid-19-battering-independent-physician-practices/

Swagel, Phill. 2020. “CBO’s Current Projections of Output, Employment, and Interest Rates and a Preliminary Look at Federal Deficits for 2020 and 2021.” Congressional Budget Office. April 24. https://www.cbo.gov/publication/56335

Velasquez, David, and Ateev Mehrotra. 2020. “Ensuring the Growth of Telehealth During COVID-19 Does Not Exacerbate Disparities in Care.” Health Affairs Blog, May. https://www.healthaffairs.org/do/10.1377/hblog20200505.591306/full/

Warner, Rachel M., Allison K. Hoffman, and Norma B. Coe. 2020. “Long-Term Care Policy after Covid-19 — Solving the Nursing Home Crisis.” The New England Journal of Medicine, May. https://www.nejm.org/doi/full/10.1056/NEJMp2014811

dddddddddddddddddd