This blog is the second part of a three-part series—“Long-Term Care Social Insurance Programs and the Home Care Workforce: A Crucial Investment”—exploring how states can strengthen long-term care for older adults, people with disabilities, and family caregivers—by designing sustainable financing models and investing in the workforce that makes care possible. The first installment examined the growing crisis facing America’s long-term care system—and why state action is urgently needed.

Many states are looking to build a new way to pay for long-term services and supports (LTSS). As outlined in the first article in this series, federal leaders have not created the necessary policies and programs to adequately pay for services and supports or ensure we have the workers needed to deliver them – so it’s been up to states to figure out a way forward. This article and the third article in this series will discuss the findings from a series of key informant interviews we held on ways to incorporate workforce needs into new LTSS payment programs. In particular, this series looks at how a social insurance model (further explained below) could, as one key informant emphasized, bring pivotal new revenue into this underfunded sector.

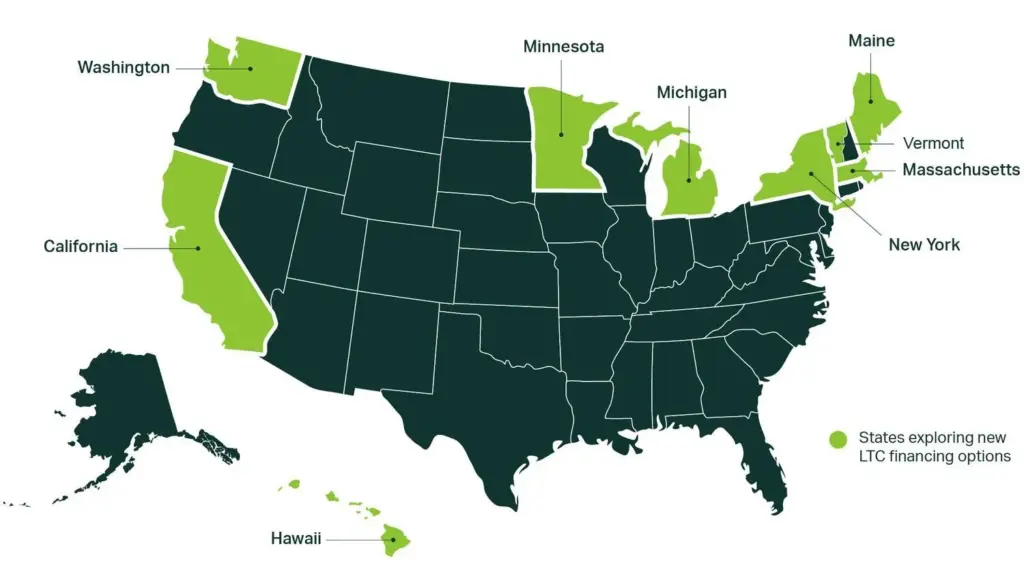

Nine states have explored whether building an LTSS social insurance program would work for them (see Figure 1 below from MIT CoLab).1 Social insurance typically utilizes a payroll tax to partially or fully fund a government-administered program. By establishing a dedicated funding source, the program would avoid the financial uncertainty that Medicaid faces due to its reliance on annual state budget approvals (in addition to the federal budget). Additionally, states have experience running social insurance programs for other services, such as for workers’ compensation, unemployment insurance, and (in some states) paid family and medical leave.2 As with these other programs, a social insurance approach to long-term care would require most people who are working to participate – thereby helping older adults, people with disabilities, and family caregivers cover a need that they might not have planned for, in a way that is more affordable (because costs are shared over a large population).

Figure 1: States Exploring New Long-Term Care Financing Options, MIT CoLab

Due to these reasons, the nine states highlighted in Figure 1 have explored proposals to build their own LTSS social insurance programs. Of those, Washington State is the only one that has passed such a program, which they have begun implementing: the WA Cares Fund.3 The Fund will begin paying out benefits in July 2026 and provides up to $36,000 in lifetime benefits for those who have paid in for at least three years. It is funded through a 0.58% payroll tax.4 Many of the other states in the map above have learned from Washington’s experience and are exploring similarly structured programs.

Underlying Premises

Strategies to support the home care workforce should be based on the following considerations:

- A new social insurance program would be one piece of a larger long-term care system that includes Medicaid, private insurance, Older Americans Act funding, Veterans Affairs funding, and more. It would build upon, rather than replace, existing programs to create a more equitable system that supports workers, older adults, people with disabilities, and family caregivers. Consequently, it would need to coordinate with other LTSS payment and workforce development programs, and should build upon existing infrastructure where possible. Relatedly, a social insurance program should avoid duplicating existing funding streams and should focus on creating efficiencies and minimizing complexity, where possible.

- A new LTSS system should value workers and ensure older adults, people with disabilities, and family caregivers can access the services they need. Establishing new ways to pay for LTSS will not make much of a difference for families unless there are enough prepared home care workers to deliver those services. Many workers will not enter or remain in the field unless we improve job quality, including by providing a living and competitive wage, robust benefits, training, and career advancement opportunities, among other supports. Therefore, the goal is not to sustain the status quo – which relies on low-quality, underpaid jobs – but to reimagine better direct care jobs as a core part of financing and delivering LTSS.

- Workforce investments and workforce supports must be integrated from the outset of the program, rather than as an afterthought. Recognizing the value of the home care workforce by properly financing and incorporating workforce investments and supports that improve job quality – such as wages, benefits, training, advanced roles, and more – will, ultimately, create a stronger and more resilient home care system.

These underlying premises, considered in tandem, determined the strategies that were included in this article series. For example, while strategies that create higher quality home care jobs were considered, the final recommendations include strategies that could raise standards across programs (not only within a social insurance program) to avoid creating a two-tiered system that would pull workers away from Medicaid’s vital LTSS provision.

What’s Next

In Part 3 of this series, we’ll examine a range of recommendations and strategies to ensure home care workers are supported in long-term care social insurance programs.

Editor’s Note: The views expressed in this article are those of the author and do not necessarily reflect the views of the National Academy of Social Insurance. The Academy values diverse perspectives to deepen understanding of the potential and promise of social insurance programs.

Endnotes

- MIT CoLab. (2025, February). State By State Long-Term Care Progress. Transforming Long-Term Care. https://www.transformlongtermcare.com/progress-by-state

- Johnson, J. (2022, November). Worker’s Compensation Laws by State. Forbes. https://www.forbes.com/advisor/legal/workers-comp/workers-compensation-laws/; Bipartisan Policy Center. (2025, February). State Paid Family Leave Laws Across the U.S.. https://bipartisanpolicy.org/explainer/state-paid-family-leave-laws-across-the-u-s/; Kovalski, M.A. & Sheiner, L. (2020, July). How does unemployment insurance work? And how is it changing during the coronavirus pandemic? Brookings Institute. https://www.brookings.edu/articles/how-does-unemployment-insurance-work-and-how-is-it-changing-during-the-coronavirus-pandemic/

- WA Cares Fund. (n.d.). How the Fund Works. WA Cares Fund: Home. https://wacaresfund.wa.gov/

- While most workers are automatically enrolled in the program, those who are self-employed must opt in to receive coverage. WA Cares Fund. (n.d.). Self-Employed Elective Coverage. https://wacaresfund.wa.gov/how-it-works/opt-in