For Immediate Release | August 23, 2004

WASHINGTON, DC – In Ohio, total workers’ compensation payments rose to $2,388 million in 2002, an increase of 6.2 percent over the 2001 level of $2,248 million, according to a new report released by the National Academy of Social Insurance (NASI).

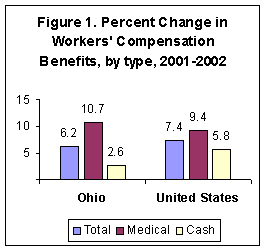

For the first time, NASI’s study shows the change in medical and cash benefit payments separately in each state. Payments for medical care grew faster than cash benefits to Ohio workers in 2002. Payments for medical care rose to $1,107 million in 2002 from $999 million in 2001, an increase of 10.7 percent. Cash payments to workers rose to $1,282 million in 2002 from $1,249 million in 2001, an increase of 2.6 percent (Figure 1).

Ohio’s total payments grew more slowly than for the nation as a whole. Nationally, workers’ compensation payments grew by 7.4 percent to a total of $53.4 billion. Spending for medical benefits contributed to the increase in total payments. Nationally, spending for medical benefits rose by 9.4 percent, while cash payments to workers rose by just 5.8 percent.

Workers’ compensation pays for medical care and cash benefits for workers who are injured on the job or become ill due to job-related causes. In providing health care and cash payments to disabled workers and their families, workers’ compensation is second in size only to the sum of Social Security disability insurance and Medicare.

For the nation, workers’ compensation payments rose faster than wages for the second year in a row in 2002. “This occurred in part because wages grew hardly at all, following the economic recession that began in March 2001,” noted NASI Study Panel Chair John F. Burton, of Rutgers University. The year 2002 saw the slowest growth in wages in more than a decade (0.4 percent) and a decline in the number of covered workers for the second year in a row.

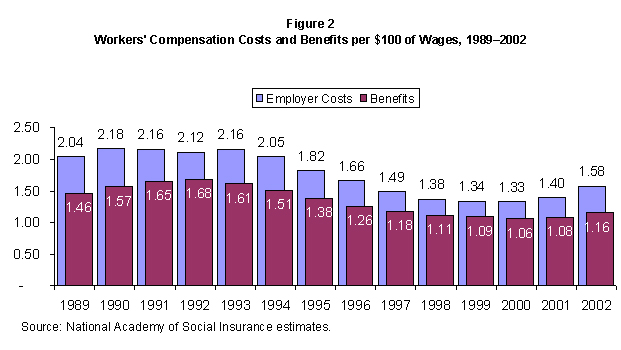

Nationally, workers’ compensation total payments for cash and medical benefits per $100 of wages grew by eight cents, to $1.16 in 2002 from $1.08 in 2001 (Figure 2). This is lower than the peak in 1992, when benefits were $1.68 per $100 of wages.

Total employer costs rose by 13.0 percent in 2002 to $72.9 billion. Costs to employers reflect premiums charged by insurers and benefits plus administrative expenses of employers who self-insure. Employer costs per $100 of wages rose to $1.58 in 2002 from $1.40 in 2001, but still remain well below their 1990 peak of $2.18 per $100 of wages.

“Because each state has its own rules for workers’ compensation,” noted Burton, “it is essential to have comprehensive and consistent national and state data to evaluate the impact of these programs on workers and employers.”

The report, Workers’ Compensation: Benefits, Coverage, and Costs, 2002, is the seventh in a NASI series that provides the only comprehensive national data on this largely state-run program. The study provides estimates of workers’ compensation payments – cash and medical – for each state, the District of Columbia, and the federal programs providing workers’ compensation benefits.

NOTE TO REPORTERS AND EDITORS: The full report and state-specific information are available from the Academy’s website at www.nasi.org. For a free copy of the printed report, contact Simona Tudose at (202) 452-8097 or by e-mail at studose@nasi.org.

Experts to Contact

Cecili Thompson Williams

Data Specialist, Income Security

National Academy of Social Insurance

(202) 452-8097

e-mail: cecilit@nasi.org

H. Allan Hunt, research perspective

Assistant Executive Director

W.E. Upjohn Institute

(269) 343-5541

e-mail: unt@we.upjohninst.org

Robert E. McGarrah, Jr., worker perspective

Senior Policy Analyst

AFL-CIO

(202) 637-5335

e-mail: rmcgarra@aflcio.org

Eric J. Oxfeld, employer perspective

President

UWC – Strategic Services on Unemployment and Workers’ Compensation

(202) 637-3463

e-mail: oxfelde@uwcstrategy.org

Virginia Reno

Vice President for Income Security

National Academy of Social Insurance

(202) 452-8097

e-mail: vreno@nasi.org

David Corum, insurance perspective

Assistant Vice President

American Insurance Association

(202) 828-7126

e-mail: dcorum@aiadc.org

Donald Elisburg, worker perspective

Attorney

Donald Elisburg Law Office

(301) 299-2950

e-mail: delisbur@infionline.net

Robert Steggert, employer perspective

Vice President, Casualty Claims

Marriott International, Inc.

(301) 380-7499

e-mail: bob.steggert@marriott.com

The National Academy of Social Insurance is a nonprofit, nonpartisan organization made up of the nation’s leading experts on social insurance. Its mission is to promote understanding and informed policymaking on social insurance and related programs through research, public education, training, and the open exchange of ideas. For more information on the National Academy of Social Insurance visit www.nasi.org or call (202) 452-8097.

See related news: Disability, Workers' Compensation, Workforce Issues and Employee Benefits