Are you interested in learning more about Social Security: Americans Agree? (Click to watch below.) This page provides more information and resources on each subtopic. Unless otherwise noted, all data on this page come from the Academy’s recent study, Americans Make Hard Choices on Social Security: A Survey with Trade-Off Analysis. For additional information on Social Security, see Social Security: Just the Facts.

“What do Americans want? A recent survey has the answer.”

To better understand Americans’ perspectives on Social Security and their views on strengthening the program for the future, the National Academy of Social Insurance conducted a nationwide online survey of 2,000 Americans ages 21 and older. The survey results were weighted to match the 2010 U.S. Census. The study also included an innovative use of trade-off analysis, a technique that enabled researchers to see how survey respondents weighed the appeal or lack of appeal of various packages of Social Security policy options.

This study, Americans Make Hard Choices on Social Security: A Survey with Trade-Off Analysis, finds a sharp contrast between what Americans say they want and changes being discussed in Washington.

Further reading:

- Americans Make Hard Choices on Social Security: A Survey with Trade-Off Analysis.

- Strengthening Social Security: What Do Americans Want? Report Highlights

- Press Release: Americans Make Hard Choices on Social Security, Prefer to Raise Payroll Taxes and Increase Benefits

“Americans want the security and stability that Social Security provides.”

In the study, 81% of Americans agreed with the following statement: “I don’t mind paying Social Security taxes because it provides security and stability to millions of retired Americans, disabled individuals, and the children and widowed spouses of deceased workers.” In a striking show of support, more than a third (36%) of Americans strongly agreed that they don’t mind paying taxes for this reason. (See Table 2 in the full report.)

Public opinion studies over the years have consistently shown strong support for Social Security. Americans agree that Social Security is critically important, especially in today’s volatile economy.

Although benefits are modest, at just $1,330 per month on average, Americans understand their importance. 85% of Americans say that Social Security benefits are now more important than ever to ensure that retirees have a dependable income.

Further information:

- Americans Make Hard Choices on Social Security: A Survey with Trade-Off Analysis.

- Economic Crisis Fuels Support for Social Security: Americans’ Views on Social Security

73% of Americans say they don’t mind paying Social Security taxes because they know they will be receiving benefits when they retire. (See Table 2 in the full report.)

Further reading:

- Americans Make Hard Choices on Social Security: A Survey with Trade-Off Analysis.

- Strengthening Social Security: What Do Americans Want?

“That’s why most Americans want to improve Social Security.”

Americans Make Hard Choices on Social Security: A Survey with Trade-Off Analysis. shows Americans agree that Social Security benefits are critically important, that benefits are not as adequate as they might wish, and that benefit increases merit consideration.

86% of Americans say that Social Security benefits do not provide enough income for retirees. 72% say we should consider increasing Social Security benefits in order to provide a more secure retirement for working Americans. (See Table 2 in the full report.)

Further reading:

- Americans Make Hard Choices on Social Security: A Survey with Trade-Off Analysis.

- Strengthening Social Security: What Do Americans Want?

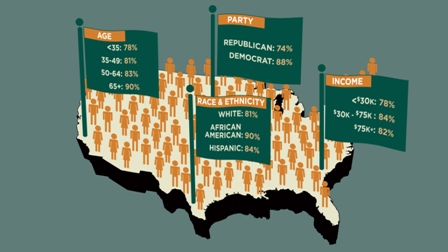

“And they are willing to pay more to keep it strong. Young and old, Republicans and Democrats, high and low income, and Americans across race and ethnicity agree.”

Americans are willing to pay more to strengthen Social Security. 77% of Americans agree it is critical to preserve Social Security for future generations even if it means increasing Social Security taxes paid by working Americans. What’s more, 83% of Americans agree it is critical to preserve Social Security for future generations even if it means increasing taxes paid by wealthy Americans.

Willingness to pay for Social Security and to consider increasing benefits is widespread and consistent across demographic lines. (See Table 9 in the full report.) Seniors in the Silent generations, Boomers in mid-career and approaching retirement, and younger workers in Generation X and Generation Y agree. Republicans, Democrats, and independents also agree. Higher- and lower-income Americans agree as well.

Further information:

- Americans Make Hard Choices on Social Security: A Survey with Trade-Off Analysis.

- Strengthening Social Security: What Do Americans Want?

- Strengthening Social Security: What Do Americans Want? Views Among African Americans, Hispanic Americans, and White Americans

“The survey finds that most Americans prefer to gradually raise the Social Security tax in two ways: a little from all workers, and a little more from top earners; …

… and increase benefits in two ways: a little for everyone, and a little more for low-paid workers.”

This study used a new approach to measuring public opinion about Social Security. In addition to asking participants whether they would favor a particular change, they were asked to choose among various packages of policy changes, much as lawmakers might do. Participants considered various combinations of 12 possible changes, including raising taxes; lowering benefits by raising the full retirement age; changing the cost-of-living adjustment; means-testing benefits; and increasing benefits.

The most favored package of changes — preferred to the status quo by seven in 10 participants across generations and income levels — would:

- Gradually, over 10 years, eliminate the cap on earnings taxed for Social Security. This would mean that the 6% of workers who earn more than the cap would pay into Social Security all year, as other workers do.

- Gradually, over 20 years, raise the Social Security tax that workers and employers each pay from 6.2% of earnings to 7.2%. The increase would be so gradual that a worker earning $50,000 a year would pay about 50 cents a week more each year, with the employer’s share increasing by the same amount.

- Increase the cost-of-living adjustment (COLA) to more accurately reflect the inflation actually experienced by seniors, who typically pay more out-of-pocket for medical care than other Americans.

- Raise Social Security’s minimum benefit so that a worker who pays into Social Security for 30 years can retire at 62 or later with benefits above the federal poverty line ($11,354 in 2015). Currently, lifetime low-wage workers are at risk of falling into poverty in their old age, even after paying Social Security taxes throughout their working lives.

Further reading:

- Americans Make Hard Choices on Social Security: A Survey with Trade-Off Analysis.

- Strengthening Social Security: What Do Americans Want?

- Strengthening Social Security: What Do Americans Want? Views Among African Americans, Hispanic Americans, and White Americans

“Social Security has never missed a payment. And Americans are willing to pay more to keep it strong for future generations.”

Social Security provides benefits to 61 million Americans every month. Since Social Security was created in 1935, it has never missed a payment. The program is projected to be fully funded over the next 17 years, but faces a long-term financing shortfall.

This study finds that Americans have a strong preference for strengthening the finances of the Social Security system and are willing to pay more to keep it strong for the future. Americans’ widespread willingness to pay more for Social Security shows that they view Social Security as a vital program that provides an essential measure of economic security for their families, themselves, and their communities.

Further information: