Are you interested in learning more about Social Security: Just the Facts? (If you have not seen the video, click to watch below.) This page provides more information and lists additional resources for exploring each topic.

“Social Security is insurance.”

Social insurance encompasses broad-based systems that help workers and their families pool risks to avoid loss of income due to retirement, death, disability, or unemployment, and to ensure access to health care. In the case of Social Security, it covers workers for the risks that go hand-in-hand with getting older but are out of one’s control, affect all of us, and are difficult to plan for.

Further reading:

- A Young Person’s Guide to Social Security (See specifically: Chapter 2, “Social Insurance: The Philosophy behind Social Security,” pgs. )

- “Short Answers to Common Questions about Social Security” (Academy fact sheet)

- Why Social Insurance? (Academy brief no. 6)

- Building on Social Security’s Success (Economic Policy Institute Briefing Paper No. 208, written by Academy Vice President for Income Security Virginia Reno)

From the Social Insurance Sourcebook:

“The retirement costs of the baby boomers are mostly paid for.”

Yearly surpluses have been accumulating in the trust fund since 1984. Social Security has collected more in revenue than it has paid out in benefits, creating substantial reserves for the retirement of the baby boomers.

Further reading:

- Social Security Benefits, Finances, and Policy Options: A Primer (See specifically “The Financial Outlook,” pgs. 18-30)

- A Young Person’s Guide to Social Security (See specifically Chapter 3: “Social Security’s Finances: If it ain’t broke, don’t break it,” pgs. )

- Social Security Finances: Findings of the 2015 Trustees Report (Academy brief no. 45)

From the Social Insurance Sourcebook:

- “How Will Boomers Affect Social Security?”

- “Social Security’s Future Finances”

- “Social Security as a Share of the Economy”

“The good news is that we can afford to keep Social Security strong.”

There are many options for making moderate adjustments to Social Security that will keep Social Security solvent for 75 years or more.

Further reading:

- Social Security Finances: Findings of the 2013 Trustees Report (Academy brief no. 42)

- Fixing Social Security: Adequate Benefits, Adequate Finances (Academy report)

- Strengthening Social Security for the Long Run (Academy brief no. 35)

- Social Security Beneficiaries Face 19% Cut; New Revenue Can Restore Balance (Academy brief no. 37)

From the Social Insurance Sourcebook:

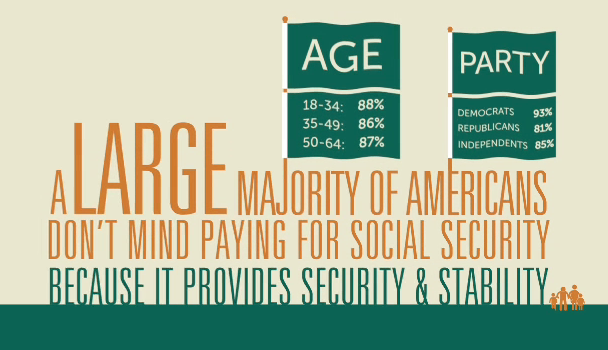

“A large majority of Americans—even across party lines and age groups—don’t mind paying for Social Security because it provides security & stability to the people who get it.”

Many public opinion polls have found that Americans draw a connection between the Social Security taxes they pay and the value they get for themselves, for their families, and for their broader communities. Moreover, working Americans also express willingness to pay more if that is what it will take to preserve Social Security for future generations. Large majorities—across party lines (88% of Democrats; 83% of independents; and 74% of Republicans) and generations (77% of Generation Y; 80% of Generation X; 84% of Baby Boomers; and 90% of the Silent Generation)—agree that “it is critical that we preserve Social Security for future generations even if it means increasing Social Security taxes paid by working Americans.”

Further reading:

- Strengthening Social Security: What Do Americans Want? (Academy report)

- Highlights from Strengthening Social Security: What Do Americans Want? (Academy brief)

- Strengthening Social Security: Views from African Americans, Hispanic Americans, and White Americans (Academy brief)

- Economic Crisis Fuels Support for Social Security: Americans’ Views on Social Security (Academy report)

- Retirement on the Edge: Women, Men, and Economic Insecurity After the Great Recession (Institute for Women’s Policy Research survey report, see specifically Chapter 3: “Support for Social Security”)

- A Young Person’s Guide to Social Security (See specifically: Chapter 4,“Social Security: the third rail of politics,” pgs. )

From the Social Insurance Sourcebook:

“The average retirement benefit is modest, $1,230 a month. Yet benefits are the main income for most seniors.”

Social Security’s benefits are modest, both in absolute terms and in terms of the percentage of wages replaced. In light of the trillions of dollars of losses in savings and home equity experienced in the last few years, the adequacy of Social Security benefits is a subject of growing concern.

Further reading:

- Social Security Benefits, Finances, and Policy Options: A Primer (Academy publication)

- Fixing Social Security: Adequate Benefits, Adequate Financing (Academy report)

- Social Security: A Key Part of Policies to Strengthen Retirement Security (Academy handout)

- A New Deal for Young Adults: Social Security Benefits for Post-Secondary School Students (Academy brief no. 33)

Additional resources from the Academy Improving the Lives of Vulnerable Americans through Social Security education project:

- Plan for a New Future: The Impact of Social Security Reform on People of Color by the Commission to Modernize Social Security

- Women and Social Security by the Institute for Women’s Policy Research

- State-by-State Factsheets: Social Security Vital to Women and Families by the National Women’s Law Center

- The Lost Social Security Benefit for Students by Generations United

- Maintaining and Improving Social Security for Poorly Compensated Workers by Shawn Fremstad at the Center for Economic and Policy Research

- Maintaining and Improving Social Security for Direct Care Workers by Shawn Fremstad at the Center for Economic and Policy Research

From the Social Insurance Sourcebook:

- “Who Gets Social Security?“

- “The Role of Benefits in Income and Poverty”

- “Children’s Stake in Social Security”

- “Social Security and People of Color”

- “Women’s Stake in Social Security”

“Social Security is efficient. Less than a penny of every dollar is spent on administration. “

Social Security spends less than one cent on every dollar on administration, even though it is collecting taxes from over 90% of the workforce and sending benefits to 61 million Americans.

Further reading:

- Social Security Benefits, Finances, and Policy Options: A Primer (Academy publication)

- A Young Person’s Guide to Social Security (See specifically “Five Arguments against Social Security,” pgs. )

- Evaluating Issues in Privatizing Social Security (See specifically, “Question 3: Individual Accounts vs. Single Collective Fund,” pgs )

“Social Security lasted through all of these unexpected events – because it was designed to weather storms.”

Social Security was passed in 1935, in the midst of the Great Depression, and has remained a stable source of income for its beneficiaries in both good and bad economic times ever since.

Further reading:

- A Young Person’s Guide to Social Security (See specifically: Chapter 2, “Social Insurance: The Philosophy behind Social Security,” pgs. )

- Strengthening Social Security for the Long Run (Academy brief no. 35)

- Why Social Insurance? (Academy brief no. 6)

- Insuring the Essentials: Bob Ball on Social Security (Published by The Century Foundation)

Additional resources from the Academy Improving the Lives of Vulnerable Americans through Social Security education project:

- A Promise to All Generations: Stories & Essays about Social Security and Frances Perkins (published by the Frances Perkins Center)

From the Social Insurance Sourcebook:

To view the video in Spanish, watch here: http://bit.ly/elsegurosocial. Para ver el vídeo en español (“El Seguro Social: Simplemente la Verdad”), haga clic aquí: http://bit.ly/elsegurosocial.