By: Elliot Schreur and Benjamin Veghte

Published: June, 2018

Independent contractors (ICs) experience many of the same risks as workers in a standard employment relationship, but face them without many of the rights, benefits, and social insurance protections enjoyed by traditional employees. Given its universal coverage and mandatory contributions, Social Security offers a reliable source of retirement income for ICs. Yet several factors limit Social Security’s effectiveness in providing financial security to these workers. This brief addresses two of these factors: risk and cost shifts to workers, and low tax compliance. After elaborating how Social Security covers ICs, the brief investigates the policy challenges arising from the two factors and offers policy options to address them.

For generations, labor market participants in the United States such as business owners, people practicing skilled trades, and consultants have worked as independent contractors without a traditional employer. In the last few decades, economists have witnessed companies’ increased use of nonstandard workers,1 a group which includes independent contractors. More recently, the online platform economy has created new forms of independent contracting known as “gig work.” Independent contractors (ICs) face many of the same risks as workers in a standard employment relationship, but face them without many of the rights, benefits, and social insurance protections afforded to traditional employees. In particular, ICs lack collective bargaining rights, employer-provided disability and health insurance, workers’ compensation and unemployment insurance coverage, and employer contributions to Medicare and Social Security. This brief focuses on policy options for better integrating independent contractors into Social Security, specifically its retirement protections.

Social Security Coverage and Benefits for Independent Contractors

During much of the last century, it was generally accepted that protections for a worker’s health, income security, and retirement would be delivered through the worker’s employer. Retirement benefits provided by employers included traditional pensions and defined-contribution savings plans, but for many workers, the most significant contributor to their retirement security was, and remains, the protection provided by Social Security.

As originally enacted, Social Security covered only employees, not independent contractors. In 1950, Congress extended Social Security protections to the self-employed.3 Since then, ICs have been required to pay an approximation of both the employee’s and employer’s shares of Social Security contributions. The current system for assessing these contributions operates under the rules of the Self Employment Contributions Act (SECA), which regulates both Social Security and Medicare contributions for the self-employed. The flat-rate 15.3 percent SECA contribution rate represents a sizable tax obligation for many self-employed workers.

Who are Independent Contractors?

Workers are considered independent contractors if they earn at least part of their total income by selling their labor through the operation of their own business. Someone who earns income by operating her own retail business selling goods to the general public would not usually be considered an independent contractor. The key difference is that ICs sell their own labor rather than goods, or put a different way, they generate income primarily from the return on labor rather than capital.

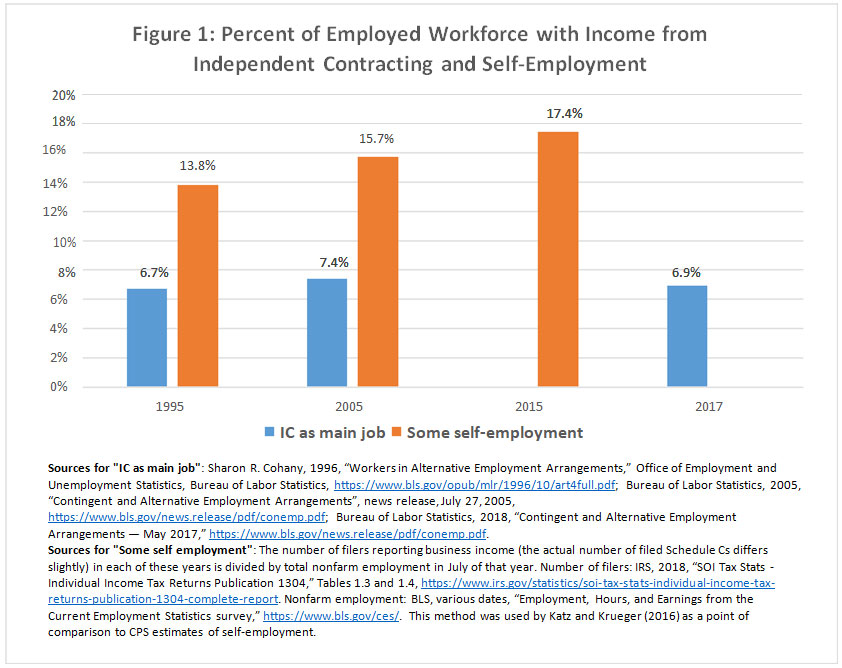

The Bureau of Labor Statistics (BLS) estimates that there are 10.6 million workers whose primary source of income is from independent contracting.5 This population makes up 6.9 percent of the employed workforce. While this estimate is a useful starting place for understanding the role of ICs in the economy, it misses a sizable population of workers whose total income includes earnings from independent contracting, but who do not consider those earnings to be their primary source of income. The share of workers with any self-employment earnings, measured by tax filings, has been rising since 2000, even as survey data, like those on which BLS relies, have indicated declines in workers who are primarily ICs (see Figure 1).6 In the future, BLS projects strong growth for the self-employed (including ICs) in low-wage occupations such as personal care, grounds maintenance, and transportation.

How Social Security Covers Independent Contractors

All workers with earned income are legally required to contribute to Social Security. This is true not only for traditional wage- and-salary employees, but also for individuals running a small business, selling crafts, driving for Uber, or offering consulting services.8 However, for a variety of reasons discussed in the next part of this paper, Social Security coverage and benefits of ICs lag behind those of wage-and-salary workers.

How employees (and their employers) pay in to Social Security and Medicare

Employees and their employers contribute equal amounts to Social Security each year. Both pay 6.2 percent of the worker’s wages up to a maximum amount (the Maximum Taxable Earnings), which is adjusted each year to keep up with changes in the economy. In 2018, the maximum amount is $128,400.

Workers and their employers also contribute equal amounts into the Medicare Hospital Insurance (Medicare Part trust fund. Each pay 1.45 percent of the worker’s wages annually. Unlike the payroll tax for Social Security, which only applies to earnings up to an annual maximum, the Medicare Hospital Insurance tax is levied on total earnings. The Affordable Care Act increased revenue for Medicare Part A through an additional 0.9 percent Medicare tax on earnings above certain thresholds ($200,000/individual and $250,000/couple).

How ICs pay in to Social Security

Independent contractors contribute to Social Security and Medicare through the self-employment tax (SET). Since ICs have no employer, they pay both the employer and the employee shares of the Social Security and Medicare contributions. Specifically, ICs pay 12.4 percent of their earnings up to the maximum taxable amount for Social Security (currently $128,400 per year) and 2.9 percent of all their earnings (without an income cap) for Medicare. This amounts to a total SET of 15.3 percent of earnings up to $128,400 and 2.9 percent on income over $128,400. An IC is also subject to the 0.9 percent Additional Medicare Tax if his or her total wages, compensation, and self-employment income (together with that of his or her spouse if filing a joint return) exceed the threshold amount for the individual’s filing status ($200,000/individual and $250,000/couple). The SET is paid in addition to any applicable federal income tax owed. Income tax owed by most ICs in 2018 is likely to be lower than it would have been otherwise due to a new deduction for pass-through business income put in place by the Tax Cuts and Jobs Act of 2017.

Independent contractors pay both the employer and employee shares of Social Security and Medicare, but they can deduct the employer’s share of the contribution from their taxable income, thereby approximating parity between the SET treatment of ICs and the payroll tax treatment of employers and employees. The 15.3 percent SET is calculated on 92.35 percent of an IC’s net income.

Policy Challenges

Independent contractors face greater challenges to achieving a secure retirement than traditional employees. ICs tend to have more volatile income streams, which inhibits their ability to adequately save for the long-term,12 and they lack the workplace retirement benefits that could support their retirement security. Employees are more likely to accumulate retirement assets in designated work-related retirement accounts than are independent contractors. Only about 4 percent of tax filers with self-employment income, like independent contractors, have chosen to contribute to the 401(k) plans specifically carved out for them in the tax code.

Social Security plays a crucial role in the retirement security of the vast majority of workers, especially those with limited pension assets. Since Social Security covers all types of work-related income, including self-employment earnings, it has the potential to play an equal if not greater role in the retirement security of ICs, compared to that of traditional employees. Yet several factors limit Social Security’s effectiveness at providing financial security to these workers. For example, income is generally lower for ICs than for employees. 14 Since a worker’s income is the predominant factor in determining Social Security benefits, lower overall earnings will generally result in lower benefits. Also, the fact that ICs do not receive a steady paycheck, but instead must often seek out contracts to perform work, means there is a higher likelihood of significant periods without income, thus lowering lifetime income on which Social Security benefits are based.

These two factors, low and volatile incomes, present acute policy problems for improving the lifetime financial security of ICs. However, in this brief, we will focus on two other policy challenges that limit Social Security’s effectiveness for ICs: ICs’ bearing the full cost of risk protection, and low tax compliance.

Independent Contractors Bear the Full Costs of Risk Protections

Independent contractors have always lacked access to many of the benefits and protections available to workers in standard employment arrangements. The rise in the share of workers with income from self- employment, however, represents a new dimension of a broader economic trend that has been termed “the great risk shift.”15 Three factors have reshaped the labor force in ways that give rise to the use of ICs instead of employees, and the large-scale risk shifts associated with their use: deliberate misclassification of employees as ICs,16 the “fissuring” of the workplace into systems of subcontracts,17 and the rise of the online-platform economy. When workers earn income as ICs rather than employees, they bear a greater burden of absorbing the costs of certain risks. Notable among these are the risks of workplace injury, unemployment, and ill health, against which employment-based programs provide protection: workers’ compensation, unemployment insurance, and sick leave and employer-provided disability insurance, respectively. ICs have access to none of these protections, with the result that the costs of experiencing any one of these risks land squarely on the shoulders of the individual worker. In addition to these costs, ICs also bear the responsibility of paying the employer-equivalent share of Social Security contributions. It is this cost shift that we address in this brief.

While the lack of employer contributions does not directly lower ICs’ Social Security benefits, which are based solely on earnings, their absence lowers ICs’ disposable income that would otherwise be available to save for retirement through other means. From the perspective of classical economics, the amount of the absent employer contributions should already be incorporated into the cost of the services that an IC charges to a company. The reason is that the perfectly rational service provider would anticipate her full tax liability due on labor and take that into account when deciding whether it is in her best interests to accept the offered contract for work. An IC would reject a contract that does not offer enough money to cover expenses, taxes, and profit (in the form of take- home pay). The independent decisions of thousands of other rational market actors would increase the cost of the service that would be required to entice an optimal number of workers to perform the service as ICs. The resulting service cost at the market equilibrium would provide an adequate payment amount for workers to cover the 15.3 percent SET that they owe on their income.

In reality, many ICs do not fully take into account the relatively high tax rate imposed on their labor during the tax year, leading to financial hardship, tax avoidance, or tax debt.18 While most independent workers have some sense that they will owe at least some tax at the end of the year, many are unaware of how much they will owe, or even fully understand the tax filing process.

Low Tax Compliance

While Social Security is designed to cover all workers’ wages up to the taxable maximum, regardless of employment classification, achieving universal wage coverage (up to the taxable maximum) depends upon tax compliance. In the real world, universal wage coverage is as difficult to attain as perfect tax compliance. In the case of independent contractors, tax compliance directly relates to retirement preparedness through the recording of earnings and collection of Social Security contributions. Generally, for independent contractors, low tax compliance will result in lower Social Security benefits and a less secure retirement due to the lower reported income on which benefits are calculated.

One of the main advantages of the Social Security contribution system for traditional employees, which relies upon automatic payroll deductions, is that neither workers nor employers face any decision points at which they can decide whether or how much to contribute. Contributions are deducted, reported, and transmitted as a matter of course. For ICs, by contrast, the processes for reporting earnings and paying in to Social Security are not automatic. ICs can reduce their self-employment taxes owed by reducing the amount subject to the 15.3 percent SET. They can do so by overstating business expenses or underreporting income. Both strategies yield higher after-tax income now, which some may value more highly than Social Security benefits later. ICs sometimes even fail to pay their taxes altogether. The absence of an automatic SET filing process, together with opportunities for underreporting or nonfiling of taxes owed, weakens the Social Security system and jeopardizes retirement security for some ICs.

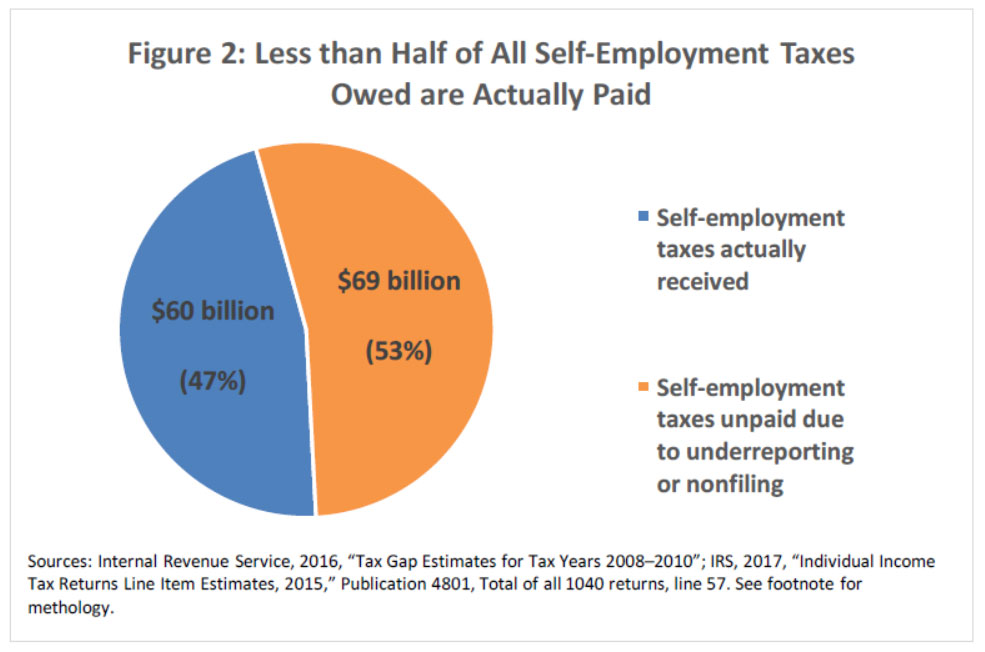

Indeed, data suggest widespread tax non-compliance among ICs, who face these trade-offs between income consumed today and income saved for later consumption in retirement. The United States Government Accountability Office (GAO) reports that two-thirds of “sole proprietors” (a group that encompasses ICs) underreport their income.20 Furthermore, evidence suggests that less than half of all self-employment taxes owed are actually paid. We calculate that whereas $129 billion in self-employment taxes are owed by U.S. taxpayers, only $60 billion of that amount is paid. 21 This leaves $69 billion in Social Security and Medicare contributions that are not flowing into the trust funds on behalf of self-employed people, due mainly to underreporting of income or overstating deductions (see Figure 2).

Looking at the entire U.S. tax system, a third of all underreporting of taxes is due to misreporting by sole proprietors.22 ICs operating as sole proprietors are some of the largest contributors to the tax gap, which is the difference between the amount of tax owed nationwide and the amount that is actually paid.23 Improving tax compliance on the part of ICs would shrink the size of the tax gap and increase the expected Social Security benefits of these workers.

The tax -filing process applicable to ICs compromises the automatic quality of Social Security contributions, which is a key strength of the program for providing retirement security. Automatic deductions are an essential part of virtually all major retirement security proposals, the necessity of which is borne out by the findings of behavioral economics, which show much higher rates of retirement savings when the process is easy and automatic.24 Contrary to these lessons, the SET filing process places the burden of complying with one’s tax obligations (and thus providing for one’s retirement security) squarely on the shoulders of the ideal prudent and forward-looking independent worker.

All workers face competing economic priorities, one of which is the choice to consume income now or save for the future. For most workers, saving for retirement is hard, and public policy can help to structure retirement programs and shift incentives to improve their retirement security. Social Security generally does a good job in helping workers provide for their future during their working years through its mandatory, automatic, and universal contribution structure. But Social Security’s strong system for ensuring greater retirement security among workers is undermined when it comes to ICs.

Strategies for Improving Social Security Coverage and Benefits for Independent Contractors

This part of the brief discusses policy options to better integrate ICs into the Social Security system. We focus on solutions that address the two policy problems discussed above: ICs’ bearing the full cost of risk protection, and low tax compliance.

1. Require Entities other than the IC to Pay an Employer-Equivalent Share of Self-Employment Taxes

In order to mitigate some of the disparity in treatment between employees and ICs, and to lessen some of the pressures ICs face to underreport their income due to the high effective tax rate on labor from the self-employment tax, this set of proposals contains ways to facilitate the automatic collection of the employer’s share of payroll taxes from entities other than the IC. These proposals differ from those that would merely facilitate automatic withholding of ICs’ taxes because these would require companies, consumers, or the government to actually contribute the employer’s share of Social Security contributions. Proposals for automatic withholding merely make it easier for ICs to remit their combined employee/employer contributions.25 But the proposals in this set go further by assessing the employer-equivalent share of Social Security contributions on entities other than the IC.

1A. Require Social Security contributions by companies that use ICs

One option would be to require the hiring entity to contribute the same percentage of income to Social Security and Medicare on behalf of a worker regardless of the type of hiring arrangement utilized. Specifically, if a hiring entity chose to engage a worker as an IC rather than an employee, it would still contribute the employer-equivalent share of self-employment taxes. A system such as this could be designed to levy a 7.65 percent surtax on contract payments for labor, and consequently to reduce the 15.3 percent Self Employment Tax imposed on workers with IC income to half of its current rate. While this appears to be a simple fix, it is easier said than done. Defining the circumstances under which the tax would be imposed and what constitutes labor for the purposes of the tax would be challenging. How would gross amounts paid to a contractor be bifurcated into payments for labor and for the costs of materials? Would the firm using the contract labor be allowed to deduct the worker’s expenses (as the worker would do for her own half of the SET) before calculating the tax? Could the worker present an itemized bill differentiating between materials and labor?

While these are difficult questions, their complexity does not surpass that of many knotty distinctions already within the tax code. A requirement for U.S. companies that use contract labor to pay one-half of the worker’s SET would equalize the cost of labor and help ensure the proper amount of Social Security contributions are made on behalf of the worker.

1B. Require entities that profit from the deployment of ICs’ labor to contribute an employer-equivalent share of payroll taxes

This option applies to companies that deploy ICs. It differs from that directly above because it applies to a broader set of firms, particularly online labor platforms, than those that would be considered to directly use the labor of ICs. This is a subtle distinction. Whether there is a meaningful difference between these entities (traditional firms and online platforms) is a contentious issue. However, we maintain the distinction here in order to broaden the scope of the policy options discussed in this paper.

This proposal is obviously targeted at app-based labor platforms, but could also apply to other firms that connect consumers directly to service providers such as home-care agencies. One likely consequence of this proposal, which would assess a 7.65 percent tax on the payments these platforms make to service providers, is that the platforms would pass on this cost to consumers in the form of higher service costs. For the reasons stated above, this cost should already be incorporated into the cost of the services. Yet many ICs do not fully take into account the relatively high tax rate imposed on their labor during the working year, leading to financial hardship, tax avoidance, or tax debt.

A problem with this proposal, also addressed in the discussion of proposal 1A, is that the determination of the amount of the payroll tax to be paid will not be a straightforward calculation. Online platforms make payments to workers, whom the companies often treat as independent contractors. As such, from the perspective of service providers (i.e., ICs), the payments made from the online platforms are gross receipts intended to cover all operating costs and taxes, plus profit in the form of take-home pay. As a general rule of U.S. taxation, business expenses are not taxed, which means that, to maintain parity with labor from employment, expense deductions would have to be made from the amount paid to contractors before the 7.65 percent payroll tax is assessed on the company.

One way the correct amount of Social Security and Medicare contributions due from the entity facilitating payment to the IC could be determined is by requiring quarterly expense filings by the IC to the firm before the due date on which the firm must make the contributions. Another way would be to allow the IC to “bill” the firm for the correct amount of contributions at the end of the year through some automatic process triggered by the filing of the worker’s Schedule SC. A third way would be to require the firm to pay the contributions on the gross amount, but then allow for reimbursement to the firm after the IC’s expense reconciliation at tax time. The goal would be to choose the option that minimizes administrative hassles for the firm while ensuring accurate contributions. Estimating these expense deductions could require extensive three-way reporting between the online platform, the service provider, and the IRS to ensure that expenses are legitimate, and that payments are made on the correct amount from the intermediary.

1C. Require end-users/consumers of services to contribute an employer-equivalent share of payroll taxes

Another policy option would be to pass on the employer-equivalent share of payroll taxes to the end-user or consumer of the service. This would be easiest to administer in cases where there is an intervening third party such as an online labor platform. Tax law often treats for-profit firms differently from consumers in terms of responsibilities towards ICs. For example, income reporting requirements such as those that involve Form 1099 apply to firms that use ICs, but not to consumers who use ICs to perform tasks such as remodeling personal homes.

One example of such a system that passes social insurance costs onto consumers is the Black Car Fund in use in New York State. The Black Car Fund provides protection to ride -sharing drivers in the state against the risk of work -related injury. The system is akin to state-based workers’ compensation systems. The mechanism that is used to impose the cost of the Black Car Fund on consumers (a small surcharge) could be adapted to assess the employer’s share of the SET on consumers of services. The transparent allocation of these funds to Social Security and Medicare would serve to remind consumers and workers of the contributory nature of these programs and of the fact that they are benefits earned through work. In this way, the clear assessment of the contributions on consumers would function similar to FICA deductions on a worker’s paycheck, which serves to remind the worker of her contributions to the program.

2. Improve Tax Compliance among Independent Contractors

Many independent contractors overreport expenses and underreport income. This noncompliance may stem from simple lack of awareness about tax responsibilities, honest mistakes made during the tax-filing process, or deliberate efforts to reduce tax liabilities. We offer three policy options that could address each of these causes of noncompliance. They form three prongs: better tax information for ICs; automatic withholding of tax liabilities, which could reduce the opportunities for mistakes in tax filing; and stronger income reporting requirements for ICs, which would reduce the opportunities for underreporting or nonfiling.

2A. Improve ICs’ knowledge about their tax responsibilities

Much of the underreporting of taxes by ICs may be the result of lack of awareness about the full extent of their tax obligations rather than deliberate attempts to evade tax liability. The IRS acknowledges that many ICs “may fail to comply fully because they are overwhelmed by the cost and complexity of meeting their tax obligations and their business requirements.”26 Discouraged ICs may simply “walk away” and fail to file.27 According to one survey of ICs working with an on-demand platform, “36% of respondents didn’t understand what kind of records they needed to keep for tax purposes.”28 A range of simple, low-cost options could have a high impact on tax compliance simply by improving awareness of tax requirements.

App-based companies such as Uber and TaskRabbit are well-situated to provide such information. For example, the home-sharing service Airbnb has published a 27-page booklet containing “general guidance on the taxation of rental income.”29 The booklet makes clear that the guide is provided merely for informational purposes, and encourages users to seek tax guidance from a professional. The clear need for such information on the part of workers (or, in the case of Airbnb, “hosts”) should outweigh the reluctance of the platforms to appear involved in the affairs of the workers providing their service. While Airbnb’s operations are largely outside the scope of this brief because income generated for its hosts is rental income, not labor income, and thus subject to different tax requirements,30 the platform’s provision of tax guidance stands as an example of a good business practice of providing proactive tax education to workers.

Another opportunity for tax education is guidance offered directly by the IRS. The IRS already provides guides for self-employed individuals31 and “sharing economy” workers.32 Although hundreds of pages of information, guidance, and instructions already exist for sole proprietors and the self-employed,33 not all workers realize that they are considered sole proprietors for tax purposes in the first place, or would use that word to describe themselves. There is a need for resources that can help workers not only find the tax forms they need, but also to simply identify their tax status based on yes-no questions about the structure of their work arrangement. A guide such as this should help workers identify their tax status with a reasonable probability of accuracy (short of the certainty that would come from consulting a tax accountant) and be used to identify their tax status and locate appropriate tax forms.

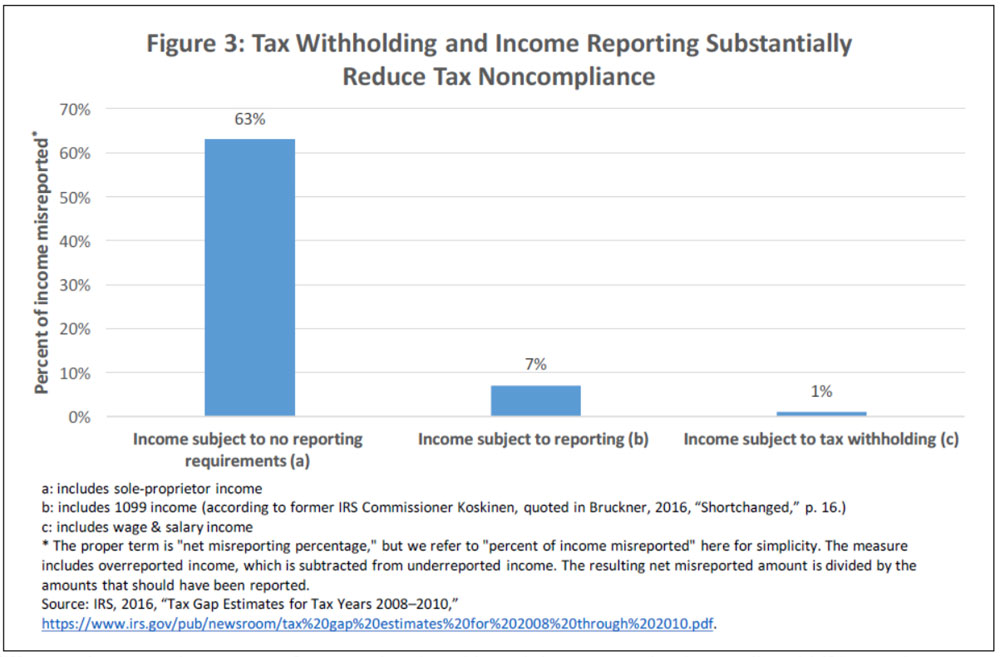

2B. Require automatic payment of taxes by ICs

The surest way to ensure tax compliance is to automatically withhold taxes due, as is done for employees. According to the IRS, when income is subject to tax withholding, only about 1 percent of income is misreported.34 But when income is not subject to either withholding or reporting, i.e., when tax forms such as a W-2 or Form 1099 are not required to be sent to the IRS, about 63 percent of such income is misreported (see Figure 3). As a general rule, the U.S. has a pay-as- you-earn tax system. Most workers are required to pay taxes throughout the year, with a reconciliation of taxes owed at tax time, around April 15th of the following year. Workers who receive wages automatically comply with this pay-as-you-earn requirement through the income- and payroll-tax withholding services of their employers. This withholding process automatically remits taxes, including Social Security contributions.

Workers earning income as ICs, however, must comply with a separate, do-it-yourself, pay-as-you-earn process. All ICs with more than about $6,500 in income35 are required to pay taxes in quarterly installments, known as estimated tax payments.36 Given that the average yearly earnings for workers providing labor through online labor platforms is about $6,400,37 a significant share of these workers are already likely required to file quarterly tax payments. Yet a third of them report not knowing whether they have to file quarterly taxes.

In addition to providing clearer information to ICs about tax reporting requirements, as addressed in proposal 2A, this option would require automatic withholding of tax payments, rather than leaving it up to the IC to proactively file estimated payments. One option would be to create requirements for withholding of self -employment taxes by the entity that uses the IC’s labor (though not requiring the entities to actually contribute the employer’s portion of the contributions). Statutory employee laws already exist for the purposes of Social Security and Medicare taxes under certain circumstances.39 However, the rules could be amended to broaden their scope and apply to more types of workers. For instance, one of the requirements to trigger statutorily required withholding of taxes for ICs is that the services be “performed on a continuing basis for the same payer.”40 This requirement may limit the types of workers for whom the taxes must be withheld, particularly transient workers who perform services for multiple businesses.

2C. Require stronger reporting requirements from firms using IC labor

While directly withholding taxes owed is the surest way to achieve high rates of tax compliance, even a requirement for certain parties to report amounts paid without withholding can significantly reduce misreporting. When income is subject to reporting, as on the Form 1099 that many ICs may receive, only about 7 percent of income is misreported.

Under current law, businesses must report payments made for services if the total payments made to an individual during the year exceed $600. 42 The $600 threshold is calculated separately for each individual paid by the business. Most businesses required to report payments to ICs must use Form 1099-MISC.43 Copies of the completed form stating the total amount of the payments are sent to the IRS and to the individual.

One way to improve tax compliance among workers with contract income would be to lower the dollar-amount threshold to trigger the requirement for payment reporting. ICs may perform work for many different firms throughout the year, each under different contracts, and each for relatively small amounts under $600. Firms using the labor of such ICs are not subject to any income reporting requirements for the workers who perform services for them.44 Given that current computer technology allows companies to keep track of payments and to automatically generate income reports for contractors efficiently and inexpensively, the marginal added burden of requiring firms to report payments to ICs totaling less than $600 may be very low. This could be an especially relevant option for workers providing labor through the growing phenomenon of online piecework (or “crowd labor”) such as Mechanical Turk. The benefit of this option could be substantially more robust income reporting for many ICs, especially those performing work on many relatively small-dollar contracts for many different firms throughout the year.

An additional problem arises with the special case of ICs performing work through online platforms. Current law requires businesses to report to the IRS using Form 1099-MISC the total annual payments made to an IC if the total annual payments are over $600. However, companies paying workers through an online labor platform are not subject to this reporting requirement. In fact, because of an unintended consequence of legislative drafting for a 2008 law, these companies are not subject to any reporting requirements whatsoever for the vast majority of the ICs earning income through their online platforms.45

Any business that pays an IC less than $20,000 using a credit card or a third-party payment processor (TPPPs) such as Venmo or PayPal falls under regulations governing IRS Form 1099- K, rather than 1099 -MISC. The consequence of this shift is that such a business does not have to report payments made to ICs unless both of the following two conditions are met: the total payments made in a year to the IC exceed $20,000, and the total number of transactions to that IC exceeds 200. If a business paid the IC using cash or a banking check, the business would have to report payments totaling over $600 to the IC using Form 1099-MISC. Simply choosing to use a certain payment method instead of another absolves businesses of all reporting requirements below a high threshold.

Uber and Lyft, the ride-sharing companies, have decided to use Form 1099 -K to report payments to drivers instead of 1099-MISC.46 A tacit implication of this decision is that the firms are setting themselves up as payment processors rather than transportation companies. The companies have vigorously defended against assertions that the drivers using their apps are employees. By using Form 1099-K, the companies are further implying that they are not even engaging drivers as independent contractors to provide transportation services. Instead, the companies’ use of Form 1099-K implies that the companies are merely serving as third-party payment processors, akin to Venmo or PayPal, accepting payments from one party and remitting a portion of those payments (after deducting a commission) to the drivers. By asserting this role as TPPPs, the companies have no obligation to report payments to a particular driver if the driver did not earn over $ 20,000 through the app and did not accept over 200 rides. Average yearly earnings from an online labor platform are about $6,400, meaning a significant portion of these workers are subject to no reporting requirements.47 Lyft has chosen to adopt the $20,000/200 threshold and to not send tax forms to drivers under the threshold. Uber has chosen to voluntarily send Form 1099-K to all drivers regardless of their earnings or the number of rides they accepted.

The reporting gap leads to problems. As discussed earlier, when income is subject to little or no reporting requirements, as are earnings below the $20,000/200 transaction threshold for TPPPs, the IRS estimates that, on an aggregate basis, 63 percent of that income is misreported. But when income is subject to reporting requirements, as is IC income over $600 reported on Form 1099-MISC, misreporting decreases to 7 percent (see Figure 3). One option would be to lower the $20,000/200 threshold for Form 1099-K reporting, or remove the threshold entirely as with Form 1099-K-reportable credit card transactions. This approach could increase tax compliance among ICs and increase Social Security coverage and benefits for these workers.

Another option would be to maintain the threshold as-is for bona-fide TPPPs such as PayPal and Venmo, but change the rules to disallow online labor platforms from using Form 1099-K.

Conclusion

Independent contractors have long made up a significant share of the workforce. In recent decades, however, macroeconomic and technological dynamics such as the fissured workplace and the development of online intermediaries have given rise to a bourgeoning of diverse independent contracting arrangements, many of which are performed by workers earning low incomes. Moreover, the long- term trend has been towards a higher portion of the workforce earning income as ICs. Traditional methods of allocating, reporting, and paying self-employment taxes are in dire need of reform to accommodate IC work arrangements. The employer-equivalent share of self-employment taxes is a particular area of concern. For Social Security to achieve its potential in providing financial security to ICs, reforms are needed. Such reforms could find creative ways to fund the employer -equivalent share of self-employment taxes, improve tax compliance among ICs, and broaden income reporting requirements.

dddddddddddddddddd