By:

Published: August, 2023

Families faced unprecedented challenges during the COVID-19 pandemic, including struggling to maintain financial security and meet the basic needs of their children and other dependents. Social safety net programs responded in a variety of ways to the instability caused by the pandemic – some of which proved worth considering for continuing long term, and some of which had unintended consequences.

Child Tax Credit (CTC)

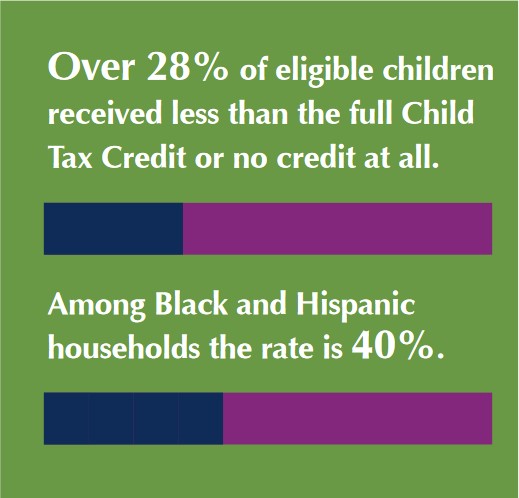

Prior to the pandemic, the CTC’s regressive design resulted in the lowest-income families receiving the lowest amount of credit. Over a quarter (28%) of eligible children received less than the full credit or no credit at all due to their families having insufficient earnings, with the highest rates among Black and Hispanic households (40%).

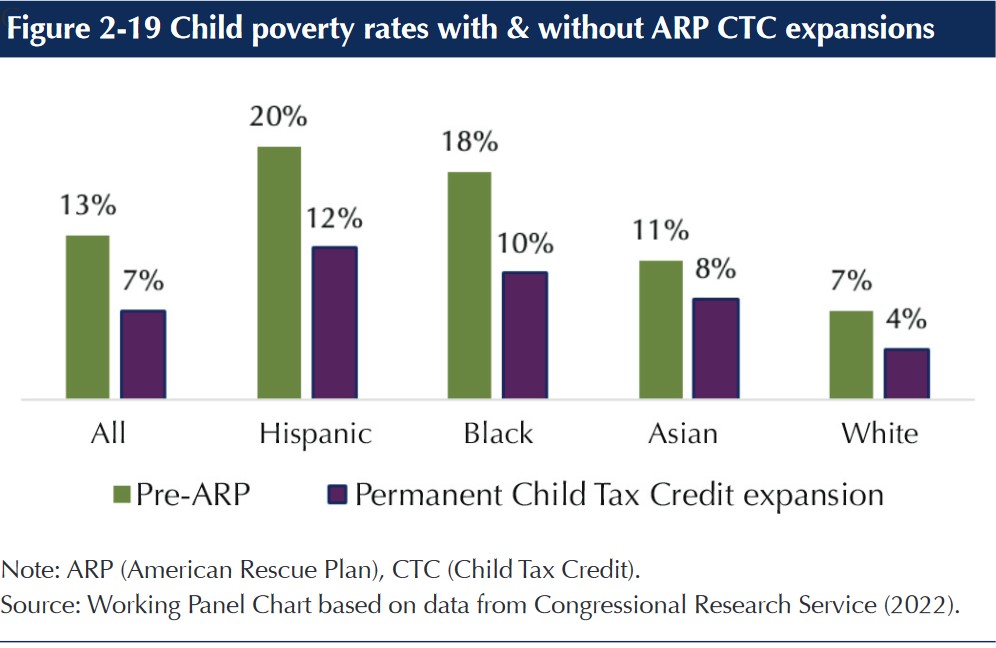

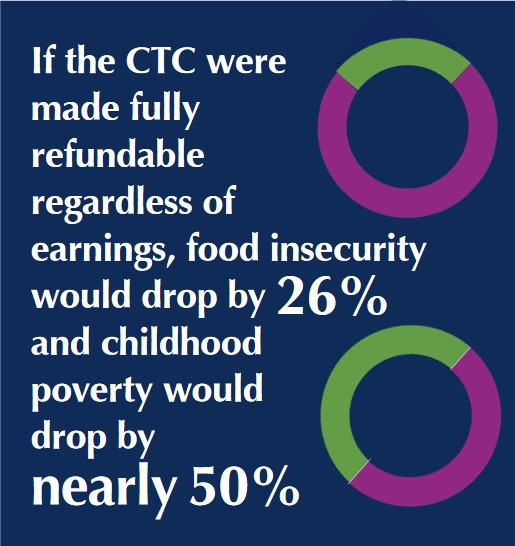

The American Rescue Plan (ARP) made the credit fully refundable regardless of earnings. If made permanent, this change would result in a 26% drop in food insecurity, and a nearly 50% drop in childhood poverty, with the largest declines among Black and Hispanic households. Additionally, the expanded CTC had no impact on employment or labor force participation.

Supplemental Nutrition Assistance Program (SNAP)

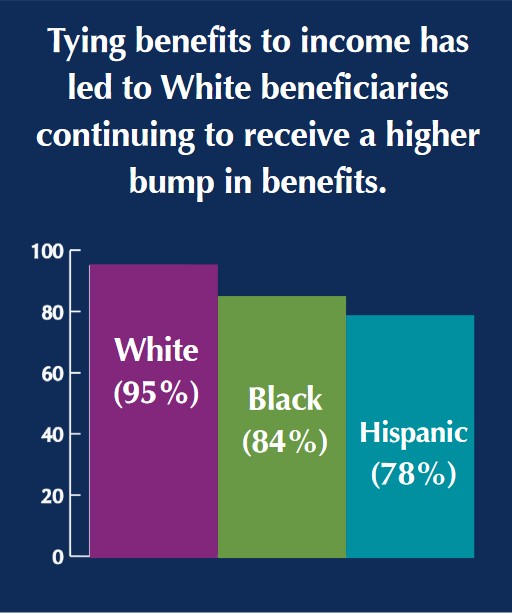

Policy changes to SNAP during the COVID-19 pandemic granted states significant discretion in and additional funding to facilitate expanding access to the program. As a result, benefits increased by 88% overall, and participation increased by 16% in 2020 and remained 12% higher than baseline rates as of March 2022. Unfortunately, the perpetuation of tying benefits to income led to White beneficiaries continuing to receive a higher bump in benefits (95%) than Black (84%) and Hispanic (78%) beneficiaries.

There are a few policy changes that would likely increase retention in the program and provide greater levels of security during economic downturns. These policy options include:

- Setting up automatic benefit increases during economic downturns

- Increasing the maximum benefit amount

- Suspending the three-month enrollment limit

- Easing the recertification process

- Increasing the federal share of administrative costs

Special Supplemental Nutrition Program for Women, Infants, and Children (WIC)

For years, WIC enrollment has been on the decline, and over half eligible children and families (57%) are not receiving the benefits for which they are eligible. Administrative barriers are a primary driver of WIC being underutilized. This was made abundantly evident during the pandemic, when variation across states in terms of enrollment varied from a 20% increase in some states to a 20% decrease in others. The most drastic decreases were seen in states that required participants to travel to a WIC Clinic and / or to drop off their WIC card physically at a clinic site in order to get benefits.

School Lunch Program

The pandemic sparked an innovative change in the implementation of the National School Lunch and School Breakfast Programs: the introduction of the Pandemic Electronic Benefit Transfer (Pandemic EBT). Through this program, families received benefits through electronic debit cards to purchase groceries directly for the value of the school meals missed due to school closures. This policy shift led to a 17% decrease in SNAP households reporting children didn’t have enough food, and a 28% reduction in the share of families overall reporting their kids didn’t have enough food.

Though most schools are now back in session, the EBT program could be shifted to cover periods such as summer break, holidays, and other school vacation periods. Current policy requires children to physically commute to their schools in order to access these programs during breaks, and only 1 in 7 eligible kids actually access the program as a result; this policy shift would drastically increase program uptake.

Medicaid, CHIP, and the Affordable Care Act (ACA)

Contrary to what happened during the Great Recession, the number of uninsured individuals decreased during the COVID-19 pandemic. This was due to a variety of factors, prominently including substantial increases in federal funding to support health care coverage. An increase in the federal share of funding for Medicaid (6.2%) and indirectly increased funding for CHIP (4.34%) was tied to requirements that states could not tighten eligibility rules, make enrollment procedures more restrictive, or discontinue coverage during the public health emergency. As a result, Medicaid/CHIP enrollment grew by 8% as of 2020, and grew to a 23% increase compared to pre-pandemic baseline by February 2022, with the largest percentage increase occurring amongst pregnant individuals.

dddddddddddddddddd