What is Social Security?

For over 90 years, Social Security has been the defining program of American social insurance. Known best as a quintessential piece of retirement planning for almost all Americans, the program’s reach extends far beyond retirement, providing key support for survivors of the deceased and people with disabilities. The people are what make this program possible, funding it through contributions from payroll taxes. Social Security is a program that has created economic security that has transcended political, geographic, and demographic divides for decades.

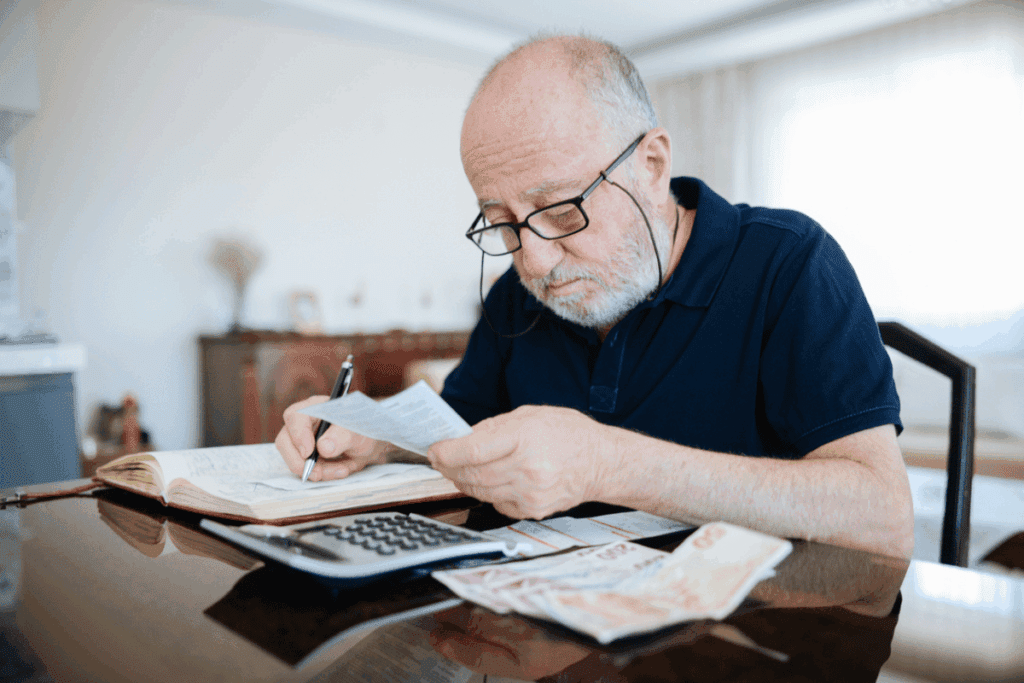

For millions of older adults, people with disabilities, and children, social security benefits mean putting food on the table, keeping the lights on, and receiving the necessary healthcare they need.

In Their Own Words

“I think I always worry about money, maybe more than I need to…I’m probably always going to worry about it. And especially now, I really depend on my Social Security. I don’t want it to go away.” – “Cecilia”

Source: The People Say

9 in 10 Americans say Social Security Disability Insurance would be important to their families income if they became unable to work.

Learn more here.

“I just need for my Social Security to keep coming in, and I will manage. Doctors and transportation have gotten a little better. That’ll be taken away without Social Security… There’s no other income.” – “Jackie”

Source: The People Say

8 in 10 Americans say Social Security will be important to their monthly income when they retire.

Learn more here.

“My primary source of income is Social Security. I have no 401(k) or that kind of retirement.” – “Charles”

Source: The People Say

Half of Americans say disability benefits should be higher, not lower.

Learn more here.

By the Numbers

1 in 5, or 73 million Americans, received Social Security benefits in 2025.

Source: Pew Research Center

In 2022, 86.9% of adults over 65 received Social Security benefits.

Source: Pew Research Center

On average, retired workers receive about $2000/month, disabled workers receive about $1580/month, and SSI recipients receive about $700/month in Social Security benefits.

“We cannot be satisfied merely with makeshift arrangements which will tide us over the present emergencies. We must devise plans that will not merely alleviate the ills of today, but will prevent, as far as it is humanly possible to do so, their recurrence in the future.” – Frances Perkins, Former US Secretary of Labor

Academy Resources

- Survey

- Event

- Event

- Event

- Event

- Issue Brief

- Issue Brief