This page provides more information and lists additional resources for exploring each topic from the video Social Security: It Pays to Wait. (If you have not seen the video, click to watch below.)

This video is also available in Spanish. Para ver el video en español (El Seguro Social: Vale la pena esperar), haga clic aquí.

View NASI’s toolkit of materials on when to take Social Security benefits — including a fact sheet and a brief.

“Many people start at 62.”

You can begin taking your Social Security benefits at any age between 62 and 70. Many people start their benefits at age 62. Of all retirees starting their benefits for the first time in 2011, 44% started at 62, and 70% started before reaching their full retirement age, according to the Social Security Administration. There are financial benefits, however, if you can wait to start your Social Security benefits at or after your full retirement age.

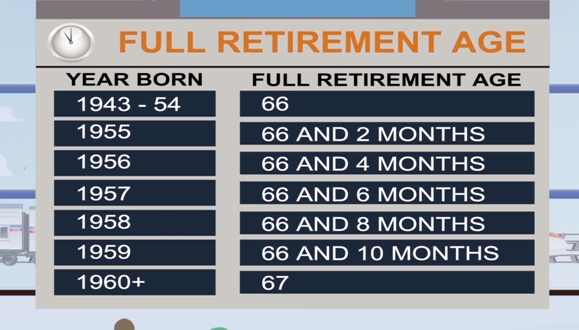

“Your full retirement age is 66 or 67, depending on the year you were born.”

Your full retirement age is the age when you are eligible for full, unreduced Social Security benefits based on your earnings history. The full retirement age has increased from 65 to 66 (where it is now, for people born between 1943 and 1954) and will continue to increase to 67 for people born in 1960 and later.

Further reading:

- Retirement Planner: Full Retirement Age (Social Security Administration)

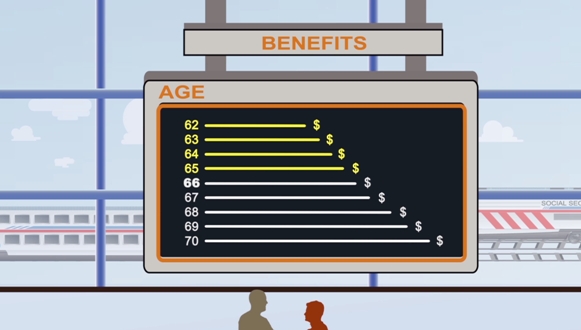

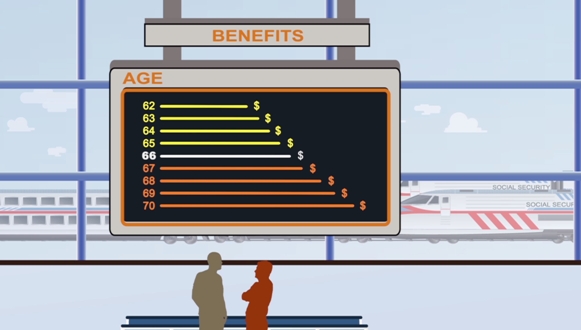

“If you take benefits before your full retirement age, your benefits are lower. If you take benefits after your full retirement age, benefits are higher. Waiting even a year or two helps.”

Every year you wait means your monthly benefit amount will go up. Your benefit is reduced if you claim Social Security before you reach your full retirement age, and it is increased for every month after full retirement age that you wait to claim, until age 70. If you wait until age 70, your Social Security benefit will be 76% higher than if you started taking benefits at age 62.

Further reading:

- When Should I Take Social Security Benefits? Questions to Consider (NASI Brief, see page 3)

- World’s Best Investment? Delaying Social Security (NASI blog)

- Retirement Planner: Benefits by Year of Birth (Social Security Administration)

“But what if you need Social Security early?”

If you are age 62 or older and need Social Security to make ends meet, you should take it. While your monthly benefits would be larger if you wait to start your Social Security benefits, some workers may face barriers to work, including poor health, physically demanding jobs, and caregiving responsibilities. Social Security is there for you, and you should claim your benefits if you need them to prevent financial hardship. If you are unable to work because of a heath condition, you may by be eligible for Social Security disability insurance benefits.

Further reading:

- When Should I Take Social Security Benefits? Questions to Consider (NASI Brief, see page 4)

- Disability Planner: Social Security Protection If You Become Disabled (Social Security Administration)

At older ages, many sources of retirement income decline. For example, at advanced ages seniors are much less likely to have income from work: 64% of couples ages 65-69 have income from work, but that declines to 14% of couples age 80 and older. Pension income usually declines in value, because most pensions are not fully protected against inflation. And savings accounts and other assets often become depleted as seniors age.

As a result, Social Security grows more important at older ages. Half of Social Security beneficiaries ages 65 to 69 rely on Social Security for most of their income, and that number increases to three out of four beneficiaries once they reach age 80 and older.

Further reading:

- When Should I Take Social Security Benefits? Questions to Consider (NASI brief, see pages 9-11)

“Benefits keep up with inflation.”

For most retirees, Social Security is the only source of retirement income that lasts for life and is automatically adjusted to keep up with inflation (increases in the cost of living) for as long as you live. The cost of living adjustment (COLA) for Social Security benefits in 2014 was 1.5 percent.

Inflation poses a serious risk to long-term economic security, especially for retirees on a fixed income. Even a modest rate of inflation can rapidly erode the purchasing power of a fixed retirement income. With an annual inflation of just 3%, – well within the range of U.S. experience in recent years – $100 today shrinks in value to about $45 in 25 years.

Further reading:

- What You Need to Know about Social Security’s 2014 COLA (NASI blog)

- When Should I Take Social Security Benefits? Questions to Consider (NASI brief, see page 6)

“Chances are, one of you will live past 85.”

Married couples have two lives to plan for in retirement. While no one can predict how long he or she will live, it is likely that one partner in a couple will live to at least age 90. Today, a 65-year-old husband and wife can expect, on average, to live 15 more years (until age 80) as a couple. And at least one spouse is likely to live beyond her or his 90th birthday.

Women tend to live longer than men and face a higher risk of outliving financial resources in retirement. Choices that married individuals make about when to take Social Security benefits have a big impact on the spousal benefits that are available once the higher earner retires or pass away.

Further reading:

- When Should I Take Social Security Benefits? Questions to Consider (NASI brief, see specifically page 7)

“If you are the higher earner, waiting to take Social Security means a higher survivor benefit for your spouse later.”

Delaying Social Security retirement benefits can increase survivor protection for couples. A widow can receive a Social Security benefit based on her husband’s work record if that benefit is higher than what she would receive based on her own work. Any increase in the husband’s benefit because of delayed claiming is passed on in the survivor benefit for his widow after he dies. The same rules apply when the wife is the higher earner and her husband outlives her.

Further reading:

- When Should I Take Social Security Benefits? Questions to Consider (NASI Brief, see pages 8-9)

- Social Security for Widowed Spouses in Retirement (NASI)

- Survivors Planner: Planning for Your Survivors (Social Security Administration)

“Studies show that most Americans agree: They value Social Security, they support it, and they are willing to pay to keep Social Security strong.”

A recent National Academy of Social Insurance study found that Americans don’t mind paying for Social Security because they value it for themselves (80%), for their families (78%) and for the security it provides to millions of other people (84%). Fully 82% of Americans agree it is critical to preserve Social Security for future generations even if it means increasing Social Security taxes paid by working Americans, and 87% agree if it means increasing taxes paid by wealthy Americans. And 72% favored a package of policy changes that would gradually raise the Social Security tax in two ways and increase benefits in two ways.

Further reading:

- Social Security: Americans Agree (NASI video)

- Strengthening Social Security: What Do Americans Want? (NASI brief)

View the full toolkit on when to take Social Security benefits.