Ori Ben-Ari, 2022 Merton C. Bernstein Intern on Social Insurance

This essay is an independent contribution by Ori Ben-Ari, 2022 Merton C. Bernstein Intern on Social Insurance. Opinions within are not expressly endorsed by the National Academy of Social Insurance. Please feel free to share your thoughts in the comment section below or reach out to Ariella Jailal, Program Coordinator, at ajailal@nasi.org with feedback.

The activism of my generation is impassioned, whether with chants, megaphones, and clever signs at a rally, or from an armchair, via Instagram stories. Whatever your political views, the barrier to organized activism has never been lower. And we protest everything: Supreme Court decisions, state laws, zoning issues. If you’re passionate about something, there’s a picket sign for you.

Oddly, one issue that impacts everyone, dramatically and without exception, relates to a program that is systematically designed to fail, but for some reason, is not even being discussed. There are no protests. There are no rallying cries. The fight is not on the streets. It’s a quiet fight in the once-noisy kitchen of an elderly widow looking at her unpayable bills. It’s plaguing the construction worker who has worked for five decades but can’t retire. It’s the reason an amputee can’t afford to pay her prescriptions. This is the battle I choose to fight.

How Did We Create this Crisis?

Old Age, Survivor, and Disability Insurance (OASDI), commonly referred to as Social Security, is the reason for the 6.2 percent “FICA Tax” deducted from most paychecks. Most young Americans know that Social Security’s funding is supposed to run out, but it’s a while away, so why worry about it? Surely the government will fix it before WE retire.

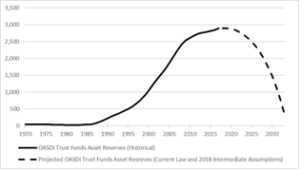

The ugly truth about Social Security is that it is designed to fail. The last major amendments to Social Security, results of the 1983 Greenspan Commission, set up Social Security’s Trust Funds such that money flowing into the system through taxes would exceed money flowing out for the next 30-35 years. It was understood, however, that as members of the Baby Boomer generation retired, the cost of benefits would exceed the incoming contributions for the following 30-35 years.

As Yogi Berra says, it’s hard to make predictions, especially about the future. But we can make some. The OASDI Trust Funds are currently set to run out of reserves around 2035, 23 years earlier than the Greenspan Commission expected. Benefits won’t stop, but Social Security will only pay out around 80 percent of the scheduled benefits, and that 20% reduction would push tens of millions of Americans who depend on Social Security for most or all of their income into poverty.

This financing crisis was built into the system back in 1983, which designed the Trust Funds to run out. So, the system is not “failing,” it’s performing exactly as planned (albeit a bit faster than projected). I’ve had the opportunity to discuss this quandary with top officials at the SSA, Social Insurance historians, and public policy professors. All agreed that while the compromises made in 1983 were the only way to keep the system afloat, they effectively kicked the financing problem down the road, where it now challenges Generation X, Millennials, and my own Generation Z.

What Can Be Done to Address our Short-Term Financing Crisis?

A range of policy options have been suggested that would improve the Trust Funds’ financial condition without cutting essential benefit levels. These include increasing the FICA contribution rate, raising or scrapping the Taxable Maximum, and taxing unearned income.

Increasing the FICA Contributions Rate

According to a recent Academy poll, most people would support increasing FICA contributions if doing so guaranteed Social Security benefits. While raising taxes generally is about the most unpopular thing a government can do, in this unique case, the vast majority — 82 percent — of Americans “agree it is critical to preserve Social Security for future generations even if it means increasing Social Security taxes paid by working Americans.”1

The annual Trustees Report assesses the financial condition of Social Security using sets of demographic and economic assumptions. According to the most recent Trustees Report, keeping the system fully solvent requires an immediate and permanent FICA rate increase of 3.24 percentage points to a combined employee and employer rate of 15.64 percent. (Waiting until 2035 to act would force the increase to 16.47 percent, so sooner is better).

The current rate of 6.2 percent isn’t etched in stone. Indeed, FICA contributions rates have changed throughout history, until 1990. Returning to those increases would ensure all beneficiaries receive their promised benefits.

Scrapping the Taxable Maximum

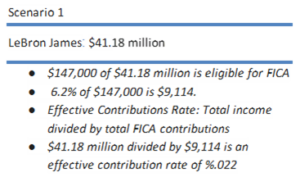

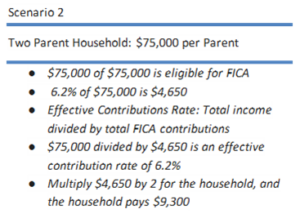

There is currently a limit on the amount of income that is eligible for FICA. As of 2022, the Taxable Maximum was $147,00; any income over that level is not taxed. As a result, LeBron James, who made $41.18 million last year, paid less in FICA contributions than a household where each parent earns $75,000.

Because it has failed to keep up with rapidly rising wages at the very top of the income scale, OASDI is missing out on billions of dollars in revenue. Raising or scrapping the cap would bring more revenue into the system and could be the first step towards a short-term solution.

What Can Be Done to Address our Long-Term Financing Crisis?

While current Social Security legislation aims to deliver the legislatively scheduled benefits to those who earn them, the long-term goal should be to create a sustainable program that avoids financial crises by adapting to demographic and economic shifts.

Benefit levels are already dynamic, rising in accordance with economic inflation levels. Why shouldn’t contribution rates be dynamically adjusted as well? If so, where might we find a good model? We need to look no further than our neighbor to the North.

Canada has an Automatic Balancing Mechanism that insulates benefits from legislative inaction. Every three years, Canada’s Chief Actuary calculates the minimum contributions rate required to finance benefits over the following 75 years. If the calculated minimum contribution rate exceeds the legislated contribution rate, but there is no political agreement on a new rate, then a safety mechanism is activated. Contributions rates are increased by 50% of the difference between the legislated and calculated minimum contributions rate for the three-year period.

This system works because it gives lawmakers the opportunity to act and improve the long-term sustainability of the system, but places the sanctity of scheduled benefits above any political games.

The Moment for Action

Setting a fixed-rate FICA contribution for the next 75 years and hoping that the system remains solvent could be accomplished by actuaries, or by throwing darts at a board. There are simply too many economic, political, and demographic variables to enable accurate predictions of the required rate. Instead, the SSA should implement a dynamic FICA contribution rate that avoids passing down a legacy of financial myopia to the next generation.

Social Security is more than a financial equation that can easily be solved. It’s one of the largest government programs, and it affects everyone in the United States. More importantly, it’s a promise from one generation to future generations. Let’s not kick this problem down the road and force our children to deal with it; let’s build a system of financial security that they can benefit from.

Ori Ben-Ari is a junior at the College of William & Mary studying public policy and philosophy. Having grown up in Israel, Ori is fascinated by and seeks to explore the vastly different Social Insurance systems and political decision-making process in the United States to those of back home. Ori worked on a framing paper explaining the financing of the OASDI Trust Funds with William Arnone, CEO, and Ken Buffin, Founder of the Buffin Foundation.

Very well written and certainly causes reason for the future.

Terrific…baby boomers should be happy to see a perceptive college student recommend ways to safeguard Social Security

I am so glad you are giving a voice to this crisis!